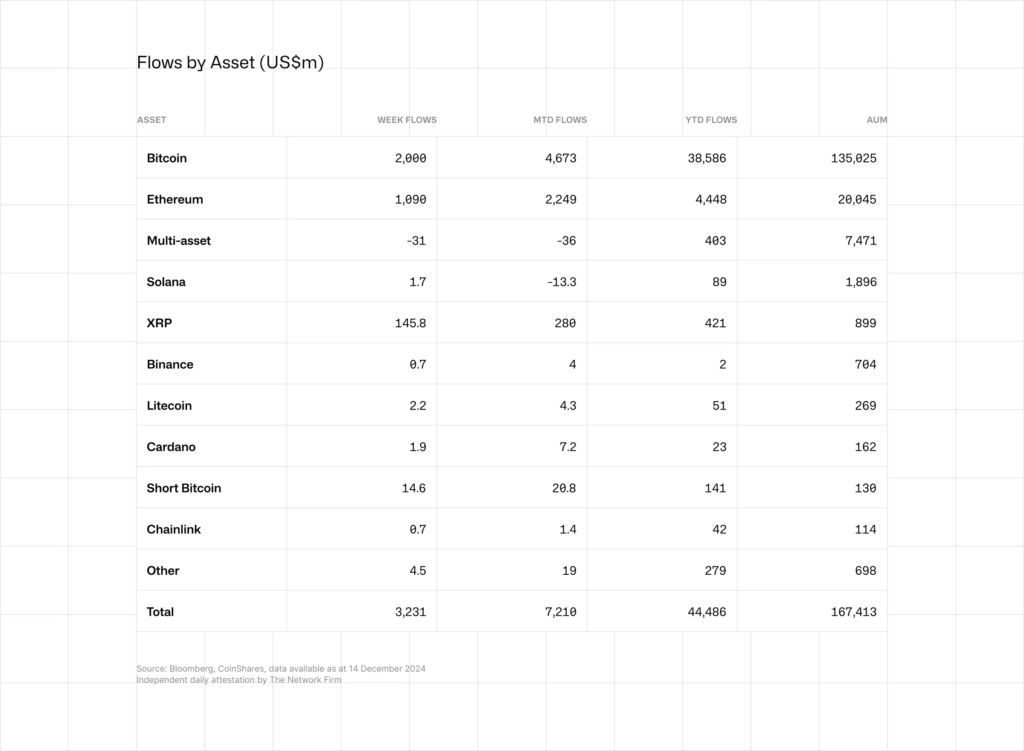

Crypto asset investment products witnessed another week of solid inflows, reaching $3.2 billion. This marks the tenth consecutive week of gains. Total inflows for 2024 have now hit a staggering $44.5 billion—4x higher than any previous year.

According to the latest report by CoinShares, The average volume of ETPs traded reached $21 billion a week. This constitutes 30% of the total volumes of Bitcoin trading on trusted exchanges. The average daily trading volume of Bitcoin on trusted platforms was $8.3 billion, representing a deeply liquid market. That is twice the FTSE 100.

This scenario did not look different when the data was further broken down on a regional basis, where positive sentiment was reflected all across. U.S. funds topped with inflows of $3.1 billion. Switzerland, Germany, and Brazil followed in the line for net inflows, gathering $36 million, $33 million, and $25 million, respectively.

Bitcoin leads crypto inflows with $2B

Bitcoin investment products remained the clear winners, recording inflows of $2 billion. Total Bitcoin inflows have now reached $11.5 billion since the U.S. elections. Meanwhile, short Bitcoin products recorded $14.6 million in inflows on the back of recent price gains. However, their AuM remains modest at $130 million.

Ethereum also continued its rally with $1 billion of inflows for a seventh consecutive week, pushing the total for this stretch to $3.7 billion and marking a dramatic turning of investor sentiment.

XRP was the top altcoin and inflows of $145 million, driven by growing optimism for a U.S.-listed XRP ETF. Polkadot at $3.7 million and Litecoin $2.2 million were the other inflows positives. Overall, the trend does now seems to indicate a broad-based recovery across the digital asset space.

Presently, the crypto market is in a much good position to see even more growth with inflows coming at record levels and trading volumes expanding. So for now, Bitcoin and Ethereum are the focal point, leading this resurgence of the digital assets.

Related | Michael Saylor hints at MicroStrategy next Bitcoin buy