Crypto investment products reached a new level last week, recording weekly inflows of $3.85 billion. This figure surpassed the previous record set only weeks earlier, indicating solid interest in the sector.

According to the latest report from CoinShares, the year-to-date (YTD) inflows have surged to $41 billion, while total assets under management (AuM) reached an all-time high of $165 billion. Comparatively, the 2021 bull cycle saw annual inflows of $10.6 billion and an AuM peak of $83 billion.

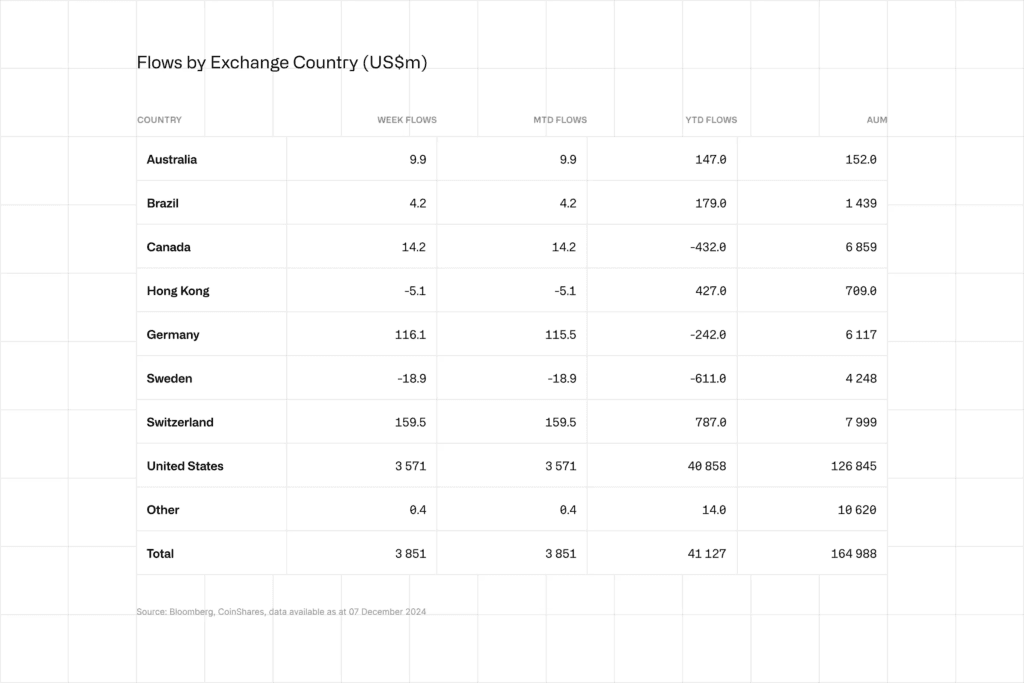

Regionally, the United States accounted for the bulk of last week’s inflows, contributing $3.6 billion. Switzerland followed with $160 million, while Germany saw $116 million in investments. Other regions included Canada, with $14 million, and Australia, with $10 million.

Leading crypto Bitcoin and Ethereum dominate inflows

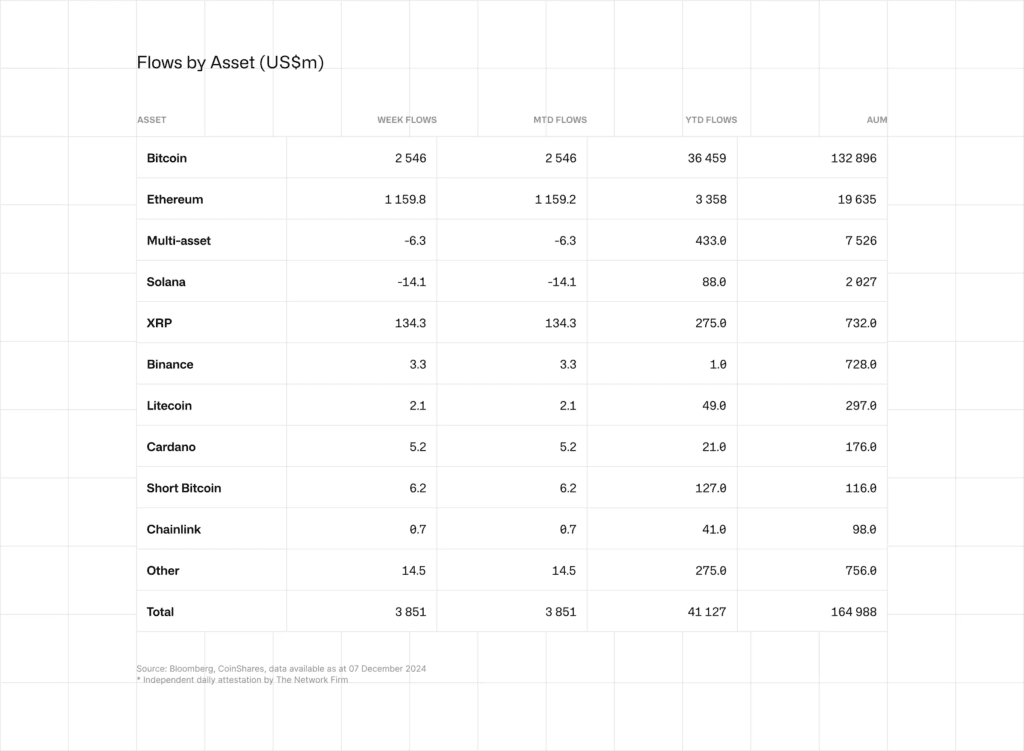

Bitcoin investment products led the charge, attracting $2.5 billion in weekly inflows, bringing the cryptocurrency’s YTD total to $36.5 billion. In contrast, products designed to short Bitcoin saw slight inflows of $6.2 million. Analysts attribute this to the sharp rise in Bitcoin prices, suggesting investors are wary of potential corrections.

Additionally, Ethereum saw unusual activity, with a record-breaking $1.2 billion in weekly inflows, the highest in its history. The spike surpassed Ethereum’s July ETF launch and came alongside large single-day inflows into Ether ETFs on Dec. 5, marking growing investor confidence in Ethereum-based products. However, Solana experienced outflows of $14 million for the second consecutive week, indicating shifting market sentiment.

Blockchain equities and Bitcoin ETFs surge

Equities activity on the blockchain was very high, with $124 million in net flows, the largest weekly increase since January. At the same time, this was accompanied by betting on better profit margins for Bitcoin miners, indicating growing optimism in blockchain-related investments.

U.S. spot Bitcoin ETFs flowed within reach of $10 billion since Nov. 5, just after President Donald Trump’s re-election. Bringing all of the ETF assets to around $113 billion, Bitcoin reacted, crossing the $100,000 line for the first time on Dec. 5, as per the report.

According to a Bloomberg report, the institutional players have led the surge of all-time high inflows. BlackRock and Fidelity Investments made an outstanding contribution, with $9.9 billion in total inflows since November.

Additionally, the impact of Bitcoin ETFs is increasing, as displayed by the $1.2 billion in single-day inflows at BlackRock’s iShares Bitcoin ETF.

Related | BitGo first custodian to support Core’s risk-free dual staking