Crypto markets exhibit solid signs as they head into October, usually a month when digital assets roar, amidst high correlation with stock markets and positive macroeconomic signals in both the US and China.

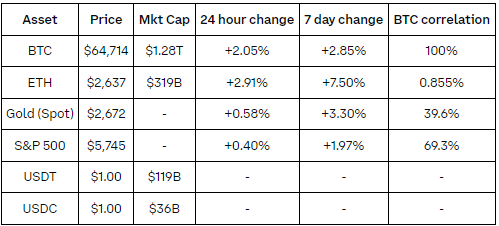

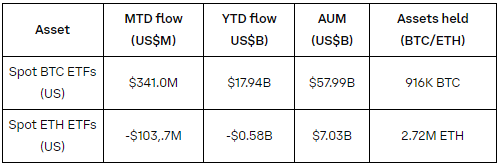

A recent Coinbase research report said that, due to major economies easing monetary policies, the crypto-stock correlation has gone up to almost 50%.

Ethereum has also outperformed Bitcoin, which is up 8% on the week, while sectors like gaming, scaling solutions, and layer-0 have surged 17%, 11%, and 9%, respectively, over the week.

Indicators paint an optimistic picture for the crypto market

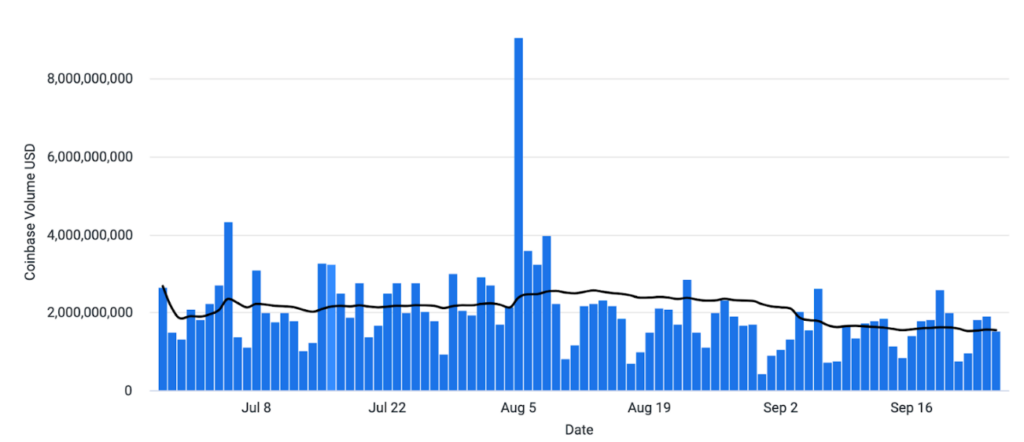

Market indicators looks good; funding rates are steady, and open interest rests at around the six-month average. This places the market in a good position as it heads into October, traditionally a very successful month for BTC, as it has risen in 8 out of the past 10 years.

The Q4 2024 macro outlook is not bad at all. China, in concert with a record-breaking rate cut and trimmed banking reserve requirements, announced fresh stimulus this week that can lift market liquidity.

In the US, an upside Q2 GDP of 3.0% also suggested low near-term recession risks despite fledgling headwinds from looming East Coast port strikes.

A breakthrough to institutional adoption came when the SEC permitted options on spot Bitcoin ETFs, specifically for BlackRock’s iShares Bitcoin Trust, known as IBIT. While trading is still pending further regulatory green lights, this could be a game-changer in improving liquidity and volumes across crypto.

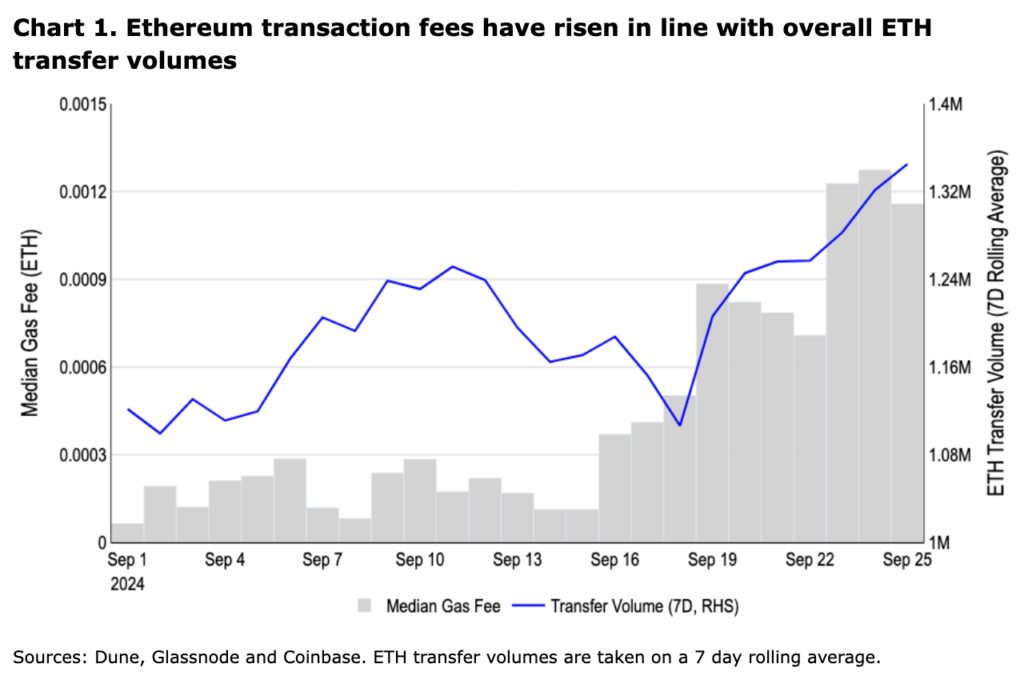

On-chain activity also signals TPS is dominating traction across chains: Ethereum transaction fees posted a 498% spike above the average of the past 30 days, while its median transaction cost went up from $0.09 to $1.69 this month.

Similarly, layer-2 solutions and also other blockchains like Solana have been in the same condition of having rapidly growing decentralized exchange volumes that have not been met with proportional fee increasess, further indication of the efficacy of scaling solutions.

Put together, these diverse factors paint what could potentially be a bullish outlook for digital assets in the near term as the crypto market enters a month that has been historically very strong.

Related | Federal court orders $36M penalty in crypto scam case