For the fifth week in a row, the crypto market saw inflows of $1.3 billion into crypto asset investment products. Investors took advantage of the recent price drops and are bullish on the long-term potential of digital assets.

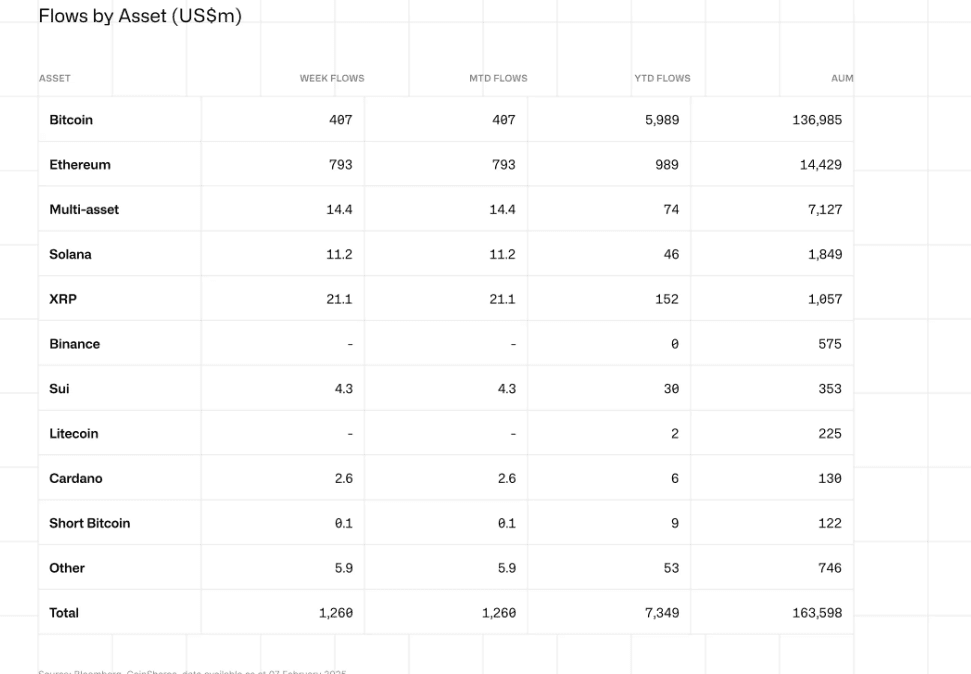

According to CoinShares, inflows are $7.3 billion. Despite that, crypto ETP AUM fell to $163 billion, 4% down from last week and 11% below the January high of $181 billion. It’s a correction, but investor sentiment is still positive as capital keeps flowing into digital assets.

Bitcoin and Ethereum lead Crypto inflows

Bitcoin (BTC) remains dominant, with $407 million in inflows. This is another sign that Bitcoin is the top asset, with ETPs linked to BTC now 7.1% of its total market cap. Institutional adoption is also rising, and Bitcoin is increasingly leading in the digital asset space.

Ethereum (ETH) was the top performer of the week with $793 million in inflows. After the price dropped to around $2,100 investors piled in to buy the dip, showing Ethereum’s growing importance in the crypto space. The demand for ETH is growing institutional and retail investor long term confidence.

Other notable inflows were XRP, $21 million, and Solana (SOL), $11 million. Blockchain equities continued to be up, with $33 million in inflows, for a total of $194 million year to date.

Crypto market sees strong institutional and regional inflows

Investment trends across different regions showed substantial contributions, with the United States leading the charge at over $1 billion in inflows. Germany followed with $61 million, while Switzerland and Canada recorded inflows of $54 million and $37 million, respectively.

BlackRock’s spot Bitcoin exchange-traded fund (ETF), iShares Bitcoin Trust (IBIT), led inflows among crypto ETPs, attracting $315 million last week. The continued interest in Bitcoin ETF shows the growing institutional demand for regulated crypto investment products.

The resilience of the cryptocurrency sector is demonstrated by the steady momentum in investments in digital assets. Investors continue to support the industry in spite of price swings and a brief decline in AUM, highlighting its long-term potential in the changing financial climate.