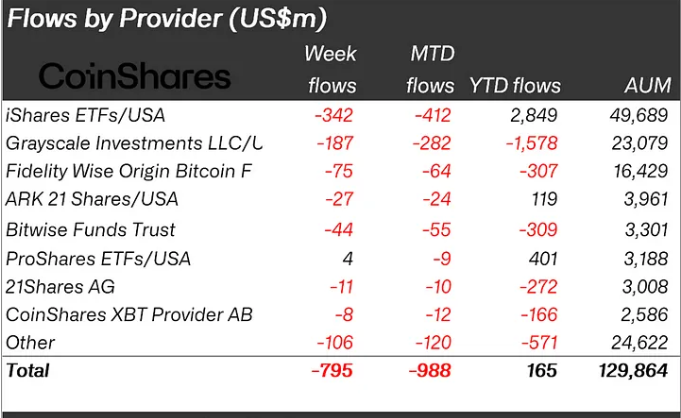

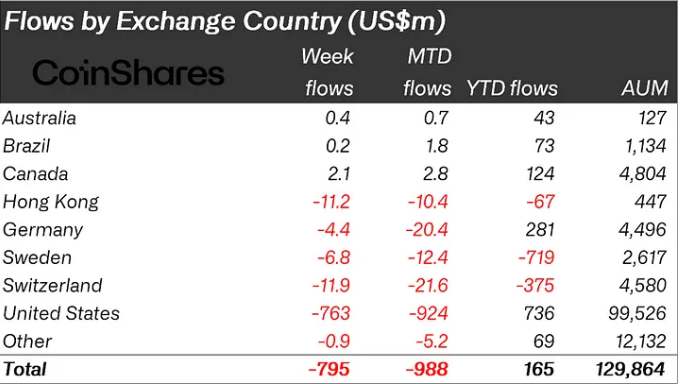

Crypto digital asset ETPs faced heavy selling last week. Investors pulled out $795 million from the market, marking the third week in a row of negative flows.

Total outflows since February now amount to $7.2 billion, which almost negated earlier gains for this year. Year-to-date inflows now total only $165 million.

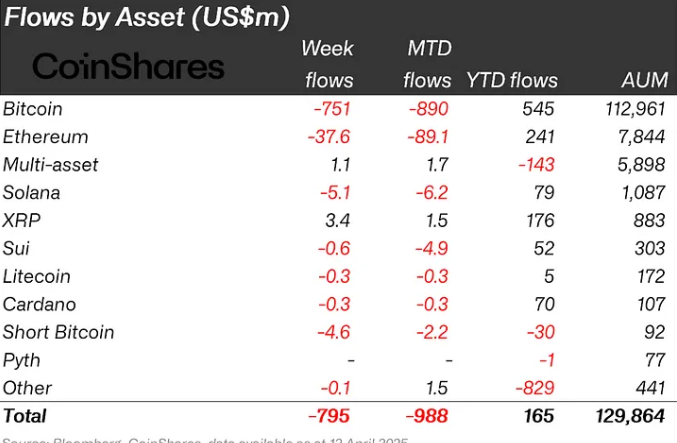

Bitcoin lost the most. It suffered an outflow of $751 million. This fall occurred despite its being in a strong position earlier in the year. Bitcoin still maintains $545 million in YTD flows.

Crypto Bright Spot XRP Sees $3.5M Inflows.

Ethereum was not far behind with a loss of $37.6 million. Other cryptocurrencies such as Solana, Aave, and Sui also registered losses. Solana lost $5.1 million. Aave and Sui lost $0.78 million and $0.58 million, respectively.

Short-Bitcoin products were not immune to the sell-off either. Investors pulled a total of $4.6 million from them. This is evidence that there was a bearish sentiment that permeated all aspects of the market. Outflows were from various countries and fund providers. It does not seem like an isolated regional phenomenon.

In contrast to the negative trend, a few coins posted gains. XRP enjoyed an influx of $3.5 million. Ondo, Algorand, and Avalanche also posted minimal gains. Each posted between $0.25 million and $0.46 million. These small gains, though scarce, indicated investor pockets of confidence.

Policy Shift Sparks Market Recovery

Later in the week, digital assets rallied. Prices regained ground after a significant policy reversal. President Trump rolled back some of the fresh tariffs. The move improved the overall sentiment. Assets under management increased to $130 billion. That was up 8% from the April 8 nadir.

It was the lowest since early November 2024. The market remains on the lookout for signs. While some remain popular, there are pressures faced by most.

Damage from previous outflows still lingers. Investors are still apprehensive, with many waiting for firmer indications of stability. Over the next several weeks, we will know if this rebound had substance or if additional outflows are to follow.