According to a recent survey by the Federal Reserve, the crypto trend is quite unusual: the ownership of crypto is not increasing at the same rate as the market’s rapid growth.

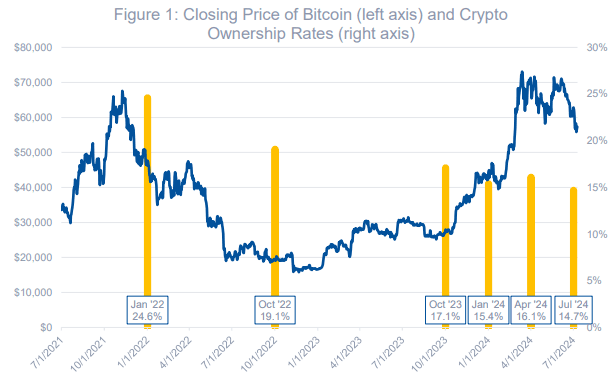

The Consumer Finance Institute (CFI) has been monitoring crypto ownership through six surveys since Jan. 2022, with the latest data collected in July 2024. Despite Bitcoin’s (BTC) rise to a five-year high, the share of crypto owners has not changed over the years.

When the winter of 2022, commonly referred to as “crypto winter,” set in, the ownership rates of crypto dropped as expected due to the price decline. On the other hand, the market recovery has not stimulated the inflow of investors into cryptocurrencies. According to the CFI survey, there was a significant drop in the ownership of cryptocurrencies to 15.1%, despite BTC being close to recent peaks.

Growing interest Vs. ownership stagnation in crypto

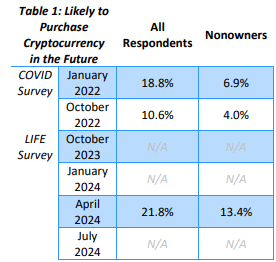

This is the discrepancy in price and adoption that has a question mark on it. Although ownership rates are stagnant, interest in future crypto purchases is on the rise. In April 2024, 21.8% of all respondents (including current owners) were likely to buy digital assets, up from just 10.6% in Oct. 2022. Those who do not own this figure increased from 4% to 13.4%.

The CFI’s data comes from two surveys: the COVID-19 Survey of Consumers (Jan. and Oct. 2022) and the LIFE Survey (Oct. 2023 onward). There are slight methodological differences, but researchers found the results to be comparable after weighting and cross-referencing responses.

However, this ownership plateau starkly contrasts the mania that is the rollercoaster digital asset market. The lowest prices were recorded through BTC in late 2022, and then a slow upward crawl occurred throughout most of 2023. A change started in Oct. 2023. The prices skyrocketed 60% by Jan. 2024 and even beyond the pre-crash figures.

Nevertheless, the obvious gap between the markets’ performance and mainstream consumers’ acceptance of crypto creates a task for the crypto industry. Rising prices may attract speculative investors, but they have not yet reached a larger group of actual cryptocurrency holders.