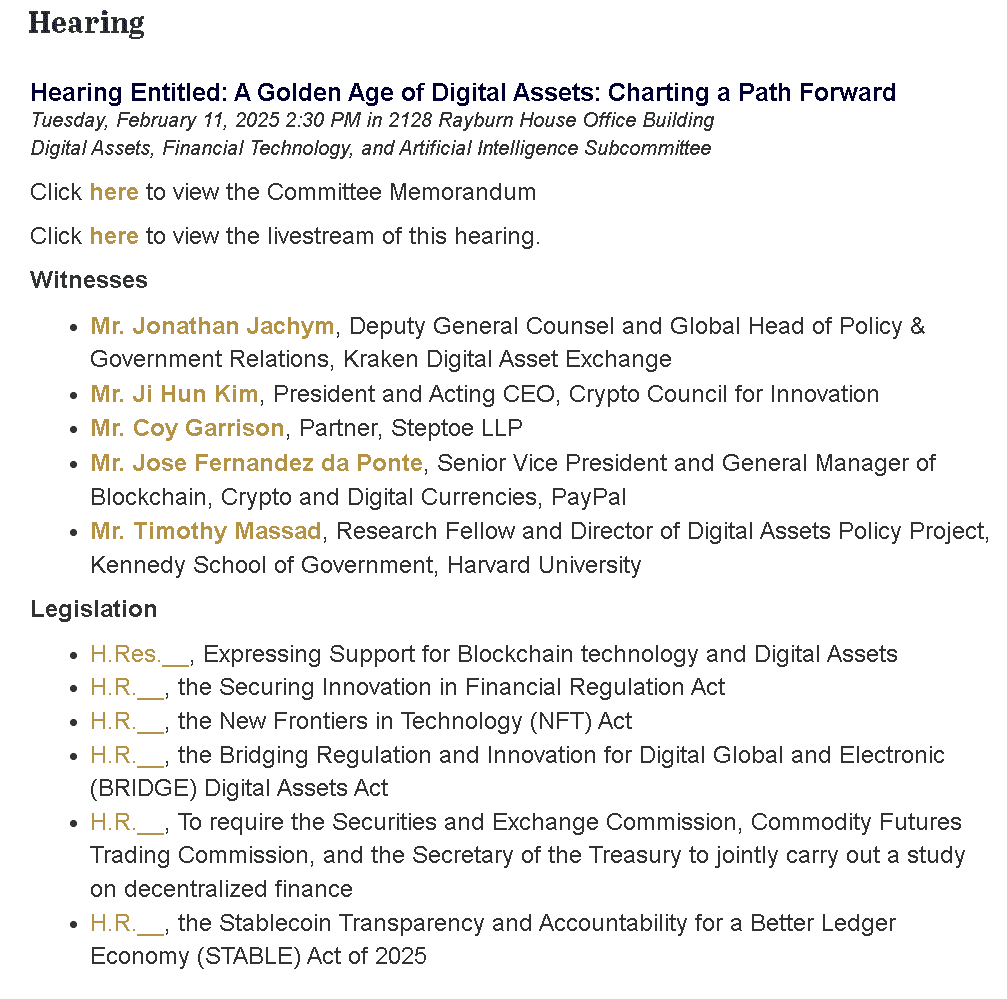

Lawmakers and industry leaders push for sweeping crypto regulations under President Donald Trump’s administration. They aim to keep the U.S. ahead of global competitors. On Feb. 11, a key House subcommittee will hold a hearing titled “A golden age of digital assets: charting a path forward.”

Executives from PayPal, Kraken, and Harvard University will testify. They will discuss the runaway growth of cryptocurrencies and the need for clear regulations. Bitcoin has surpassed $100,000, and that is stoking new interest in digital assets. Major investment firms now offer exchange-traded funds (ETFs) tied to crypto.

Blockchain’s potential has expanded beyond speculation. Traditional finance firms are integrating it to solve complex problems. Mastercard has emphasized that security, trust, and ease of use are essential for adoption. Banks and fintech companies now explore tokenized money and assets.

Banks control nearly $18 trillion in commercial deposits. Many now test tokenized deposits on the blockchain. This method could speed up transactions and allow conditional payments. Stablecoins, backed by fiat currency, are also growing. Their real-time movement and programmability make them attractive for business payments. About $200 billion in U.S. dollar-based stablecoins are in circulation.

Trump’s crypto task force and the push for regulatory clarity

Regulatory clarity will shape crypto’s future. Trump has vowed to be the “crypto president.” His administration launched a crypto task force within the SEC. He also signed an executive order on digital assets, directing agencies to develop clear rules. Meanwhile, the EU’s Markets in Crypto-Assets regulation took effect, providing a structured approach to cryptocurrency oversight.

Central banks are shifting focus. Initially, many planned to issue digital currencies. Now, they lean toward supporting financial institutions with blockchain solutions. Trump’s executive order bans central bank digital currencies (CBDCs), citing financial stability concerns. Instead, institutions may develop blockchain-based solutions for settlements and transactions.

Interoperability, security, and trust remain critical. Bad actors have been removed from the space. More mainstream investors and traditional financial firms now engage with cryptocurrency. Companies like Mastercard and JPMorgan are leading efforts to create secure, scalable blockchain solutions.

Crypto’s evolution continues. Regulatory clarity and institutional adoption will define its next phase. With more banks and businesses embracing blockchain, digital assets could become a cornerstone of modern finance. The coming year will determine whether the U.S. seizes its opportunity or lags behind global competitors.