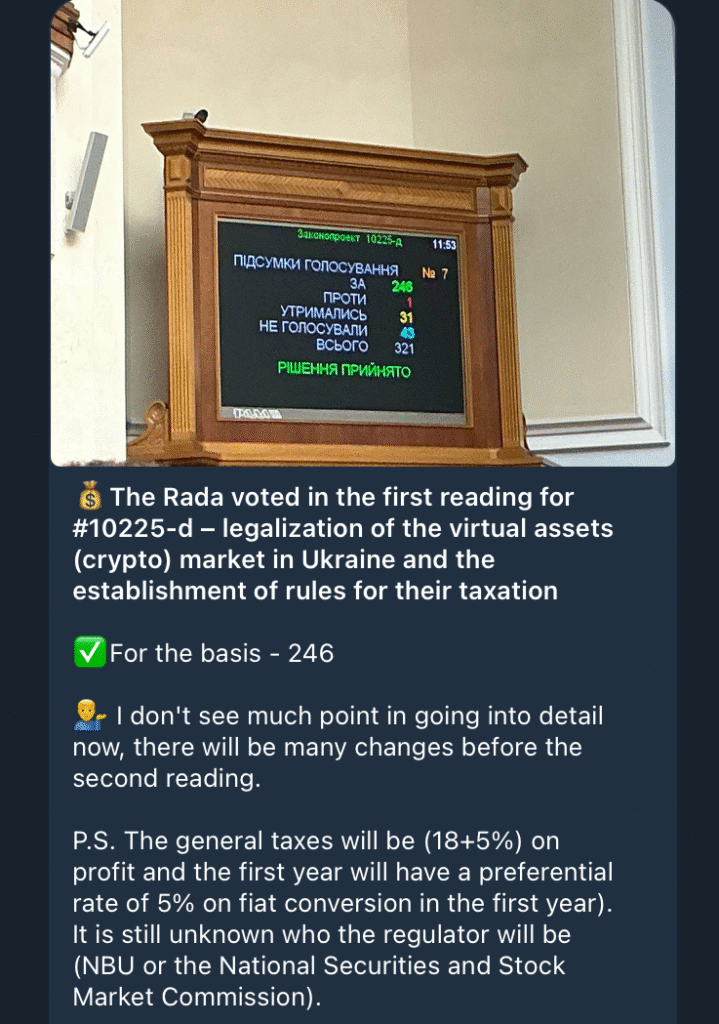

The Verkhovna Rada, Ukraine’s parliament, has approved the first reading of a bill that seeks to legalize and tax crypto. Lawmaker Yaroslav Zhelezniak announced that 246 lawmakers voted in favor of the draft. If finalized, the bill will introduce new rules for profits earned through digital assets in one of the world’s leading countries for crypto adoption.

The proposed legislation sets an income tax of 18% and a military tax of 5% on gains from digital assets. It also establishes an interim 5% preferential tax rate on the conversion of fiat money in its inaugural year. This system is similar to previous suggestions by Ukraine’s financial regulator, who recommended exempting stablecoin and crypto-to-crypto transactions to converge the system with the rest of the world.

Debate over regulators and implementation

Even though the initial hurdle was cleared by the draft law, major details are not yet settled. Legislators have yet to decide whether the National Bank of Ukraine or the National Securities and Stock Market Commission will act as the respective official regulator. Zhelezniak stated that additional alterations are imminent preceding the second reading.

The nation has been consistently progressing digital asset regulations over the past few months. In June, parliament suggested the establishment of a crypto asset reserve, followed by the preparation in August of the taxation bill for its initial reading. Ukraine comes eighth among the most active states in crypto adoption by Chainalysis, which highlights the need for the establishment of transparent legal and tax regulations.

Industry experts believe the draft law will attract investment and convince owners of Ukrainian crypto assets to transfer funds to the domestic economy. Market participants see the suggestion as part of modernization and the development of further economic resilience.

Global momentum in Crypto tax policies

However, Ukraine’s move comes amid increasingly more countries pondering models for taxing digital assets. Denmark has pondered taxing unrealized gains but the thought remains contentious. Brazil recently ended an exemption and imposed on cryptocurrency profits an across-the-board 17.5% flat tax in an attempt to raise government coffers. In the United States, politicians ponder models that would establish an orderly method for taxing cryptocurrencies.

This global momentum is evidence that there is growing acceptance of digital assets and the requirement for governments to regulate and monetize revenue in an increasingly expanding sector. Ukraine’s intention to advance adds yet another large market to this dynamic playing field.