The crypto market is taking off, with over 400 million wallets holding positive balances; that’s an increase across the board in institutional and retail users who have been drawn to different use cases with stablecoin usage and also DeFi possibilities.

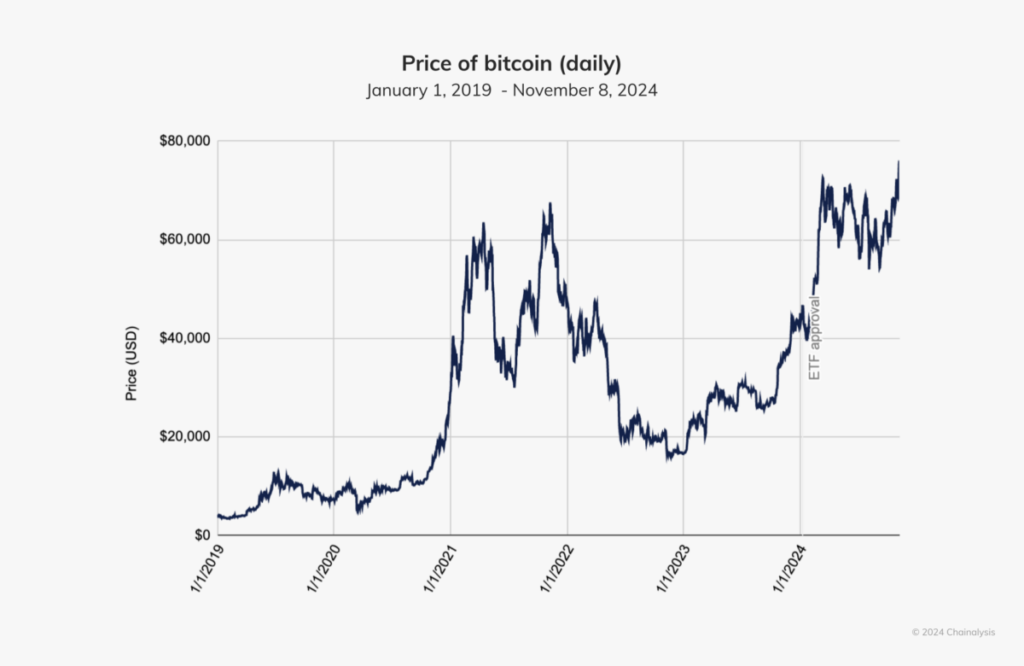

According to Chainalysis, Bitcoin (BTC) has set new milestones this year, breaching $73,000 in March and crossing $100,000 in December. DeFi activity has also surged, reaching record levels as it cements its role in the global economy.

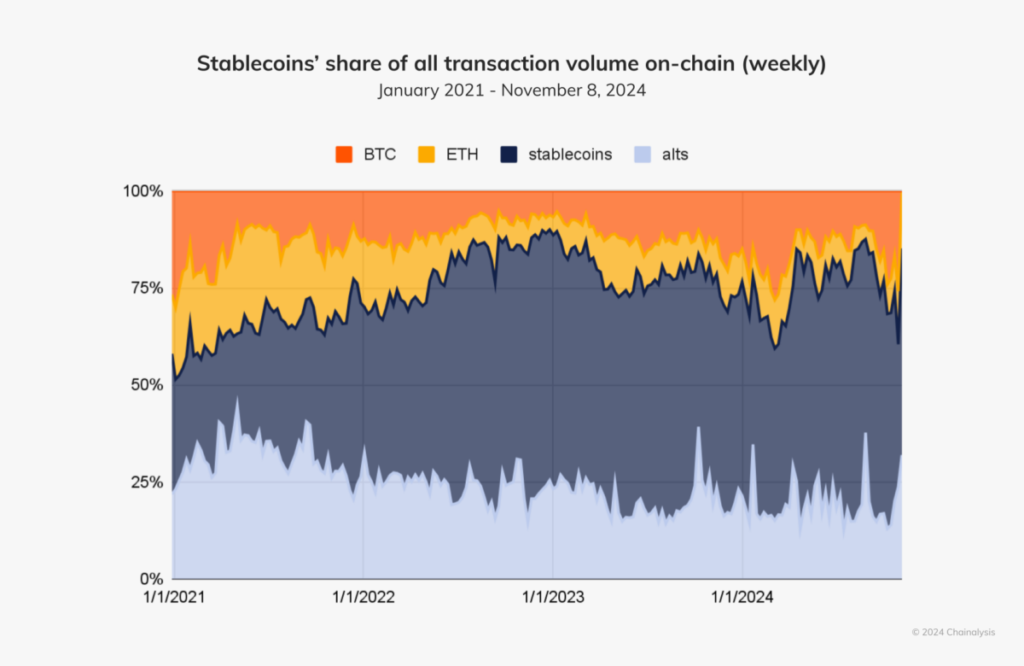

Traditional finance players are increasingly getting involved, driving the growth in crypto ETPs and stablecoins. Stablecoins lead the charge, with the on-chain transaction volume constituting up to 75% in recent months.

They have grown to be a beacon of stability and utility that reshapes financial solutions where currency volatility has plagued whole regions. Most especially, Tether, alias USDT, has become a lifeline for holding on to your savings and conducting trade.

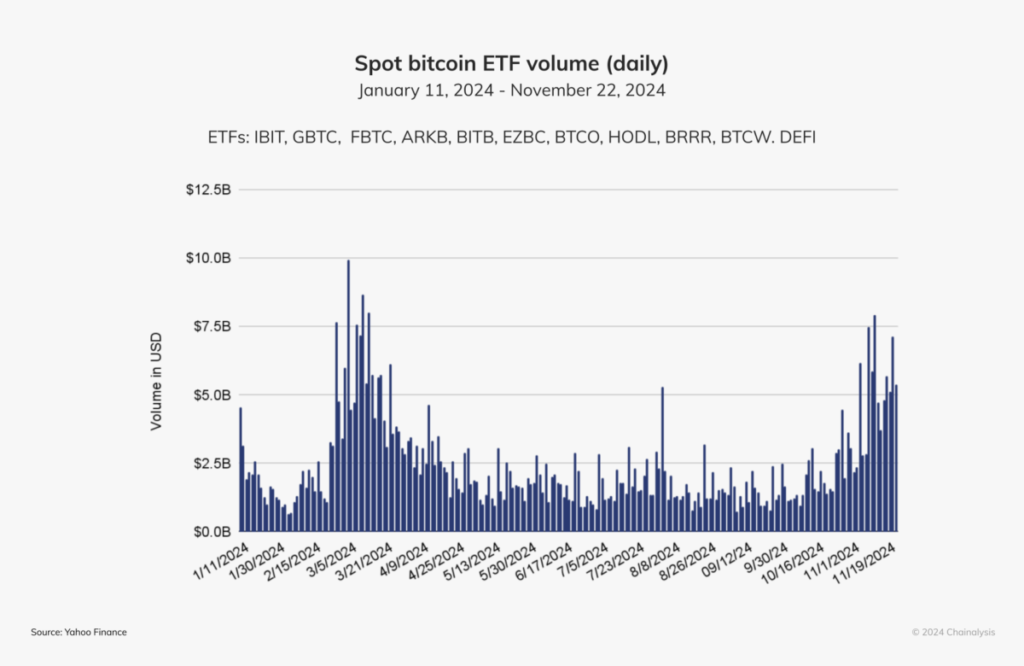

Crypto ETFs fuel institutional adoption

The growing number of American Bitcoin ETFs gave, per se, more credence to the market, which, with almost $10 billion trading in those funds within one single day this month- the demand for BTC jumped into overdrive, hence boosting prices.

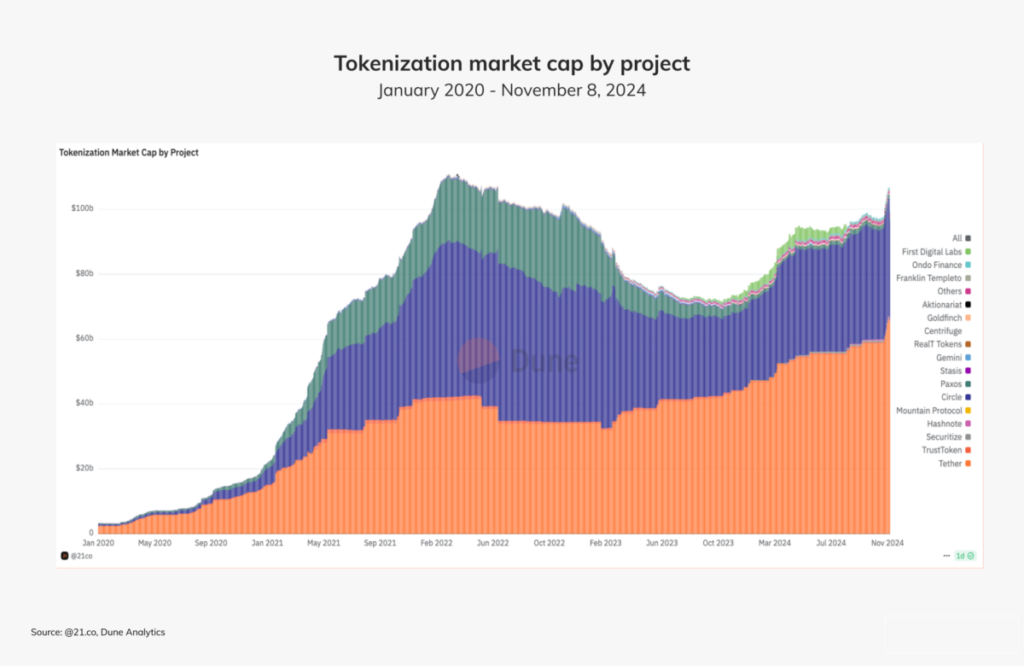

Another frontier that is revolutionizing the landscape is tokenization. Real-world assets such as real estate and treasury bills are increasingly moving on-chain. This innovation increases market accessibility, liquidity, and transparency. The total market capitalization of tokenized assets has already crossed the $100 billion mark, marking a paradigm shift.

This also leads to the growing maturity of the crypto sector, which might be a challenge in some perspectives. While the adoption goes up, so does the misappropriation by bad actors. Chainalysis helps organizations know how to handle the associated risks while keeping safety as top priority while looking to harness the potential for blockchain.

But this rally is different. It’s bigger than a market cycle; this is the moment when crypto becomes pivotal to global finance. This time, it is institutions driving and shaping the future rather than just adapting.

Related | Coinbase exposes FDIC’s attempt to halt crypto banking services