Crypto exchange Kraken has officially acquired the futures trading platform NinjaTrader. The company shared that its revenue for the first quarter surged by 19% compared to the same time last year, reaching $471.7 million.

In a May. 1 report, Kraken said its acquisition of NinjaTrader will give U.S. users access to traditional derivatives trading. The move is part of Kraken’s broader strategy to grow its range of services and become a one-stop shop for all kinds of trading.

NinjaTrader is officially registered as a Futures Commission Merchant with the Commodity Futures Trading Commission. Last month, it started offering access to more than 11,000 stocks and ETFs (exchange-traded funds) to some of its U.S. customers.

Kraken revenue, trading volume fall on Trump’s comeback

Kraken called the deal the biggest ever between a cryptocurrency company and a traditional financial institution. The exchange has partnered with NinjaTrader to expand the trading platform into the UK, continental Europe, and Australia. The agreement comes as Kraken prepares for its planned IPO in early 2026.

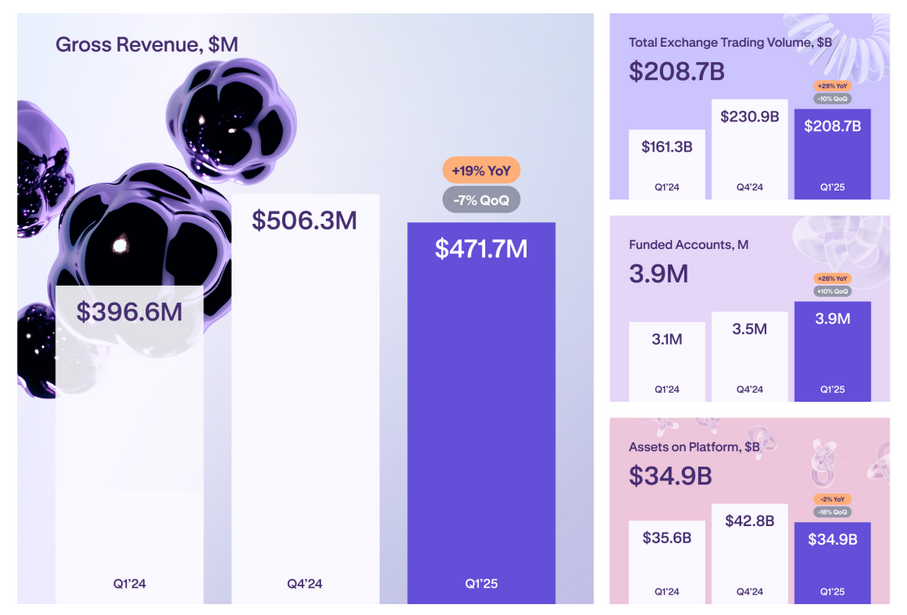

The company is considering a debt package ranging from $200 million to $1 billion to promote that transaction. Kraken revenue for Q1 hit $471.7 million, which is a 19% increase compared to the same time last year. However, it’s a 6.8% drop from the previous quarter (Q4 2024).

The exchange reported a 9.6% drop in trading volume, falling to $208.7 billion compared to the previous quarter. Additionally, the value of its custodial assets decreased by 18%, reaching $34.9 billion over the same time.

Kraken explained the drop to a “slowdown in overall market trading activity” as US President Donald Trump threatened to implement broad tariffs, which led to an 18% decline in the crypto market’s value over the quarter.

Kraken is one of several crypto platforms that saw a surge in trading activity in Q4, with levels reaching record or near-record highs. The rise was driven by the increased market volatility following Trump’s success in the November election.

Kraken said that despite a “sluggish market,” its adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) jumped 1% from the last quarter to $187.4 million. The company also saw a 10% increase in the number of funded accounts on its platform, reaching 3.9 million, indicating deeper client engagement.

According to Reuters, Kraken made changes to its workforce following Arjun Sethi’s appointment as co-CEO last October. Since then, Sethi has let go of around 400 employees.