Cryptocurrency exchange Kraken has launched a new derivatives trading platform in Bermuda after getting approval from the Bermuda Monetary Authority (BMA). Bermuda is quickly gaining attention as a favorable spot for crypto regulations, with Kraken joining other big names like Coinbase International and HashKey Global in setting up operations there. According to the Bermuda Monetary Authority (BMA), Payward Digital Solutions was granted a Class F Digital Business License in July. 30.

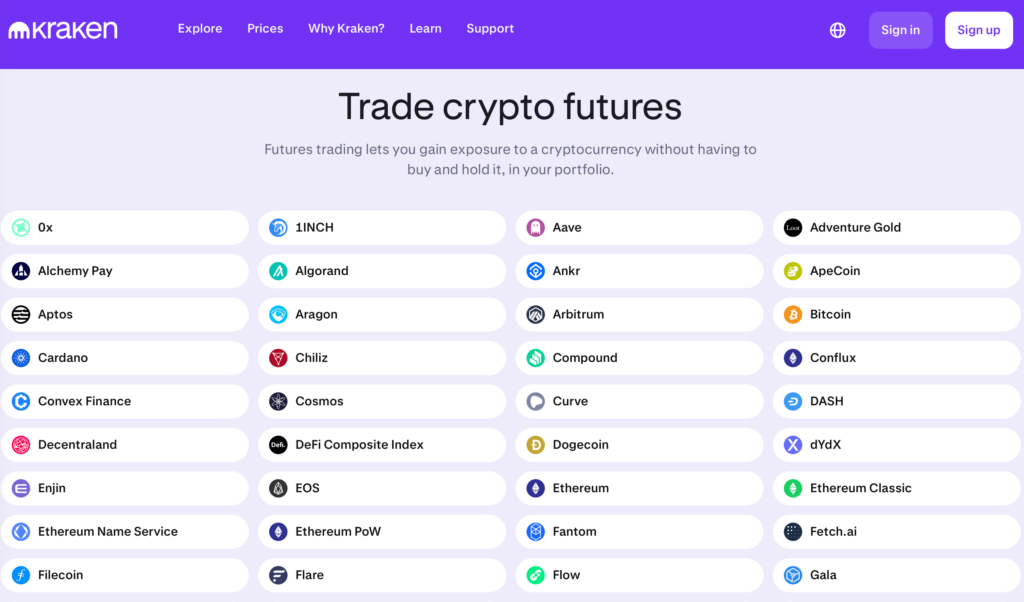

This allows Kraken to offer wallet services, run a digital asset derivatives exchange, and provide digital asset lending and repurchase services, among other activities. Kraken is rolling out a new platform featuring perpetual and fixed-maturity futures, offering over 200 contracts. Users can trade with fiat currencies or more than 30 types of cryptocurrencies as collateral.

Kraken’s SEC struggles in Bermuda

In its announcement, Kraken highlighted the ideal timing of this expansion. Kraken’s trading head, Shannon Kurtas, mentioned that derivatives now make up most of the crypto trading volume, and they expect this trend to continue with increased interest in derivatives. The exchange announced that customers in certain areas could access the platform, though they didn’t clarify which regions qualify.

Since Premier E. David Burt took office in 2017, Bermuda has been actively growing its crypto industry. The Bermuda Digital Asset Business Act, introduced in 2018, has been a key part of that effort. In 2018, Binance set up a “global compliance base” in Bermuda, creating around 40 new jobs. The Bermuda Stock Exchange hosted the world’s first Bitcoin exchange-traded fund (ETF) two years later.

In Sept. 2023, Coinbase International launched retail perpetual futures trading under Bermuda’s regulatory framework. Earlier in April, Hong Kong-based HashKey Group opened HashKey Global in Bermuda, highlighting the island’s strong regulatory environment.

Burt spoke at the Wyoming Blockchain Symposium in August, emphasizing that Bermuda takes pride in being a jurisdiction that meets international compliance standards. Kraken co-hosted the event, and Burt’s remarks were included in Kraken’s announcement.

In Feb. 2023, Kraken settled with the U.S. SEC by paying $30 million and agreeing to shut down its staking services in the U.S. Later in November. The SEC further charged Kraken for running its crypto trading platform as an unregistered securities exchange, broker, dealer, and clearing agency.

Related | SEC appeals Ripple court decision