Kraken is preparing to list Hyperliquid’s USDH stablecoin along with its native HYPE token. If the proposal gains approval, trading could begin immediately. Facilitated by one of the bidders for Hyperliquid’s stablecoin contract, Paxos Labs, the news is massive for the ecosystem.

Kraken committed that USDH and HYPE will be listed on day one should Paxos wins the upcoming bid. This listing can accelerate the process of Paxos listing USDH on Hyperliquid’s platform. The development underlines just how exchanges and stablecoin issuers are coming together globally for the purpose of supporting the usage of DeFi globally.

The listing also indicated highlighted for the incorporation of free USD on/off ramps. The service would facilitate more user accessibility for Hyperliquid’s worldwide ecosystem. However, the listing remains subject to normal due diligence for Kraken. Approval will signify whether the tokens proceed directly to active trading on its platform.

Paxos submits a strong proposal for USDH

Hyperliquid revealed on September 5 the plans of launching the USDH ticker through validator voting. USDH is going to be USD dollar-backed 1:1. Competing issuers will be responsible for deployment, and Paxos is advocating one of the strongest such proposals. Its proposal is dedicated to stimulating the growth of the community through incentives and collaboration.

First, Paxos implemented fee-free swaps of USDC, and the return of 95% of the reserve interest back to Hyperliquid via HYPE rewards and buybacks. It released the updated version on September 10. The improved version incorporated stronger community incentives, PayPal integration, and overseas growth strategies for broader expansion.

Hyperliquid USDH stands out because it enables support for ecosystem development and liquidity. Paxos, which oversees $160 billion of tokenized positions, became the pioneer. If USDH replaces Hyperliquid’s $5.5 billion of USDC deposits, potential buybacks could provide up to $191 million of annual market value.

Why Kraken’s potential listing matters

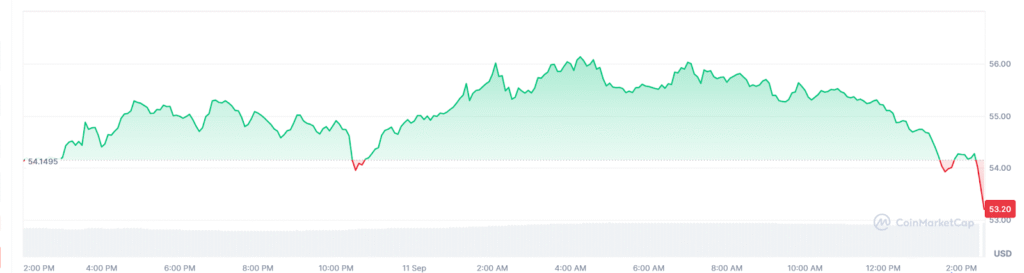

HYPE, at $53.33 after a day’s depreciation of 1.77%, underpins Hyperliquid governance. It enables community voting like USDH rollout votes. A listing on Kraken can boost its liquidity and grant institutional investors easy access through Paxos’s existing PayPal and Venmo integrations.

Hyperliquid accounts for decentralized perpetual futures with a 70% market share, registering $383 billion in volume for last month. USDH and HYPE listings by Kraken and free ramps may attract traders into paying reduced fees and encourage additional ecosystem adoption. The integration reveals strong traction behind the expanding growth of the DeFi marketplace.

Paxos competes with Agora and Frax Finance for the issuer contract. The interest by Kraken to list the version of USDH by Paxos can support its edge over competitors. With more incentives and cooperation, USDH is being positioned favorably by Paxos as the lead stablecoin of Hyperliquid’s speedy growing financial ecosystem.