Established in 2019 in Singapore, Matrixport has quickly become a leading asset management firm in cryptocurrency, managing around $6 billion in assets. The company is making significant strides in the industry with a presence in over 40 countries and a dedicated team of 290 employees.

Matrixport is now expanding its European presence by acquiring Crypto Finance, a Swiss-based crypto asset manager. On Sept. 30, Matrixport announced that it had completed the all-cash purchase of Crypto Finance Asset Management (CFAM).

Further, Matrixport recently acquired CFAM, which used to be part of Crypto Finance Group, owned by Deutsche Börse Group. After the acquisition, Matrixport rebranded CFAM as Matrixport Asset Management (MAM).

Matrixport gains FINMA approval

Now operating as a Switzerland-based arm of Matrixport, the company will concentrate on delivering top-tier crypto investment services for institutional clients. Specifically, the announcement states the deal has passed all required regulatory checks, including Swiss Financial Market Supervisory Authority (FINMA) approval.

Additionally, several top executives from Crypto Finance have taken positions within Matrixport’s new Swiss division. According to the announcement, Stefan Schwitter, the former head of asset management at CFAM, has been named the new CEO of MAM. Moreover, he added:

We’re excited to partner with one of the true pioneers in the crypto space. Our complementary strengths will add value to the existing and future client base of Matrixport Group on a global level.

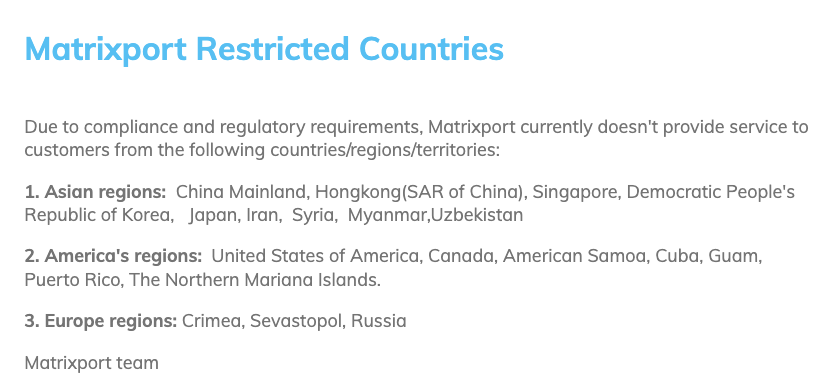

Matrixport’s FAQ indicates that the platform does not offer services to customers from certain countries and regions, including mainland China, Hong Kong, Singapore, North Korea, Japan, the United States, Canada, and others.

Additionally, the company offers asset management services and shares valuable digital asset investment research with its clients. Consequently, at the end of 2023, their analysts made an exciting prediction: they believe Bitcoin could reach $125,000 by the end of 2024.