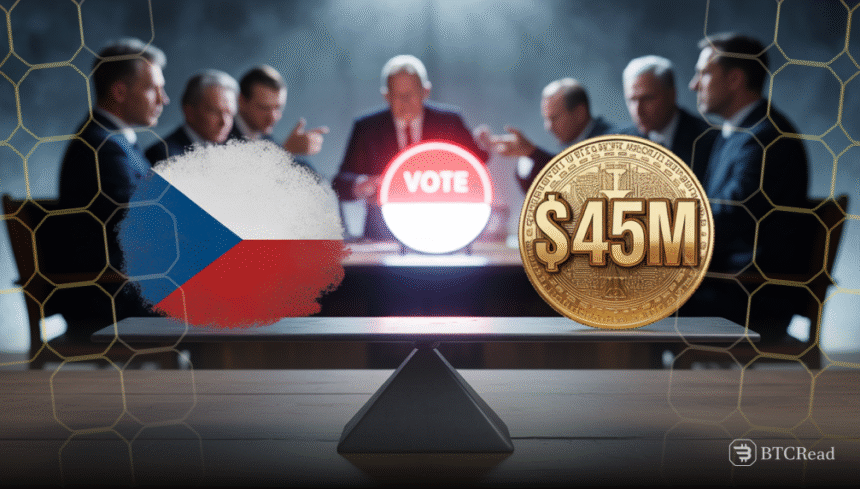

The Czech Republic is already facing the political consequences of the disappearance of more than 45 million dollars worth of Bitcoin from the state coffers. The event has prompted a no-confidence motion in Prime Minister Petr Fiala’s government.

The motion was initiated by the opposition ANO party and its leader, ex-Prime Minister Andrej Babiš. The stolen cryptocurrency was first confiscated in a 2022 raid on darknet transactions.

Cybersecurity lapses and internal mismanagement

The cybercrime unit of the Czech Police carried out an audit and found that 1,100 Bitcoins were missing from the Interior Ministry’s digital wallets. The Czech Cyber and Information Security Agency reported that staff later stored the private keys in unencrypted form. As a result, unauthorized personnel could access them. Analysts termed the loss inevitable in the absence of multi-signature wallets, air-gapped storage, and access logs.

Under heavy scrutiny, Interior Minister Vít Rakušan acknowledged failure in cybersecurity but refused to step down. Prime Minister Fiala promised to investigate the matter thoroughly, but pointed the blame at systemic vulnerabilities left over by past governments. Parliament has entrusted a commission to analyze all procedures related to digital asset possession and confiscation.

Public pressure and global attention

The people’s reaction has been swift. Demonstrations in Prague, Brno, and Ostrava have been held under the slogan “Bitcoin Is Ours.” More than 300,000 citizens have signed a petition calling for resignations and transparency. Recent polls show that 68 percent of Czechs think the government failed to handle the crisis, and 51 percent would support the no-confidence motion.

International bodies, such as the European Commission and Europol, have demanded updates. Analysts are sounding alarm bells, saying that the scandal highlights wider weaknesses in the custodial digital assets around the world. The opposition, in turn, has introduced a bill on the introduction of blockchain-based control over all government crypto wallets and increased audit protection.

A no-confidence vote, which may come in days, may bring down the five-party ruling coalition or trigger early elections. The scandal has brought attention to the issue of secure crypto asset management. It can also redefine the national and EU-level policies regarding the governance of digital assets.