Hong Kong’s Securities and Futures Commission (SFC) is seeking industry feedback on the possibility of setting up a new licensing system for cryptocurrency over-the-counter (OTC) services. If introduced, this system would involve the SFC, along with the Customs and Excise Department (C&ED), overseeing companies that provide crypto OTC trading services.

According to a February proposal, the South China Morning Post reports that Hong Kong’s Customs and Excise Department initially planned to handle the regulations and licensing for over-the-counter (OTC) crypto services. Moreover, OTC trading allows individuals to buy and sell cryptocurrencies privately.

SFC eyes new crypto custodian licenses

The SFC has recently contacted companies offering OTC trading services, asking for their input on a potential new licensing system for cryptocurrency custodians. According to the SCMP, talks about these licenses are still in the early stages, though the report did not name specific sources.

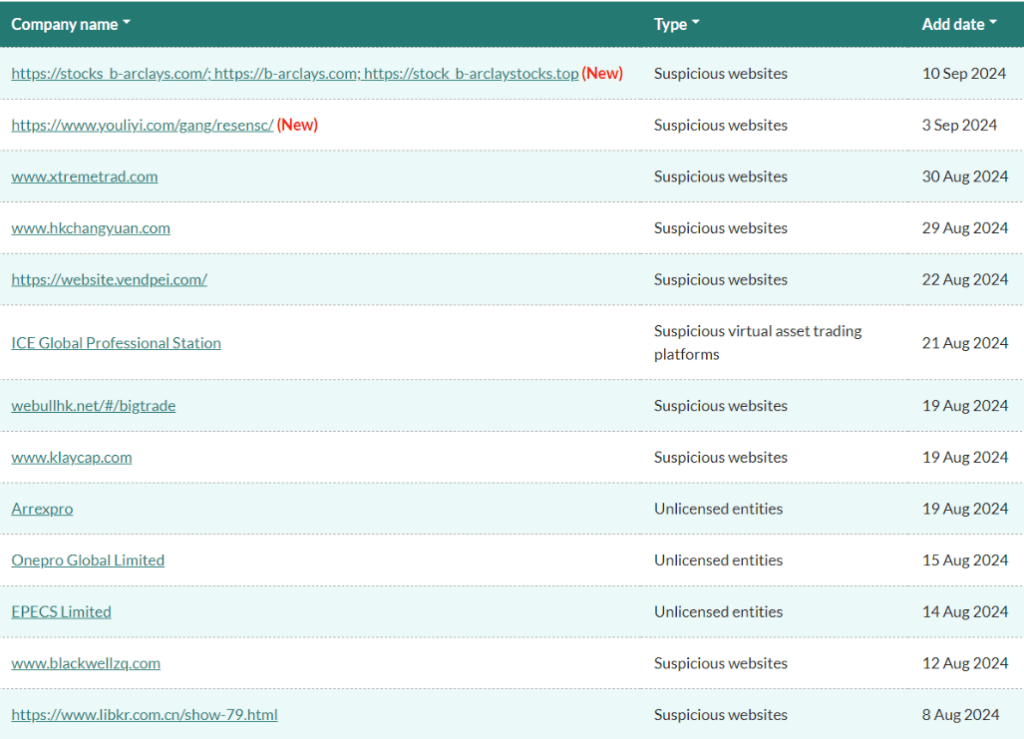

The SFC has released an “alert list” highlighting unlicensed or suspicious virtual asset trading platforms operating in Hong Kong. According to the SFC, these platforms may target investors in Hong Kong. The list, which has been active since Jan. 2020, includes websites and entities flagged as potentially risky.

Additionally, Hong Kong has been working hard to become a leading player in the cryptocurrency world, aiming to draw in investors and businesses to its growing digital assets market. As of June. 1, running a virtual asset trading platform (VATP) without a license is now illegal. Currently, only two platforms, Hash Blockchain and OSL Digital Securities, have full licenses to operate in the city.

Several crypto exchanges in Hong Kong are still awaiting full operational licenses. These include WhaleFin, Bullish, Matrixport HK, HKbitEX, PantherTrade, DFX Labs, Crypto.com, Bixin.com, EX.IO, YAX, and Accumulus.

Related | Tether faces consumer watchdog scrutiny