Tether reported a surge in USDT adoption at the start of Q4 2024. Data showed 109 million on-chain wallets with USDT, more than the number with Bitcoin and close to the 128 million carrying Ethereum. Furthermore, the company said 86 million accounts from centralized platforms have received on-chain USDT deposits.

Its latest report pointed out that, by Q3 2024, 330 million on-chain wallets and accounts had received USDT. This excludes the users of USDT on centralized platforms off-chain, thus being indicative of wider adoption. The company has labeled this as the first time in the USDT journey, followed by continued holding as the next adoption phase.

Tether notes centralized platforms’ role in the USDT ecosystem

Centralized platforms play the pivotal role here, as, during the first nine months of 2024, exchanges garnered 4.5 billion visits in total. Of those, roughly half were from emerging markets.

In many cases, users purchase, hold, and transact USDT completely within such exchanges. According to Tether’s estimates, a substantial percentage of on-chain accounts still reflect balances, pointing toward USDT reliability as a store of value.

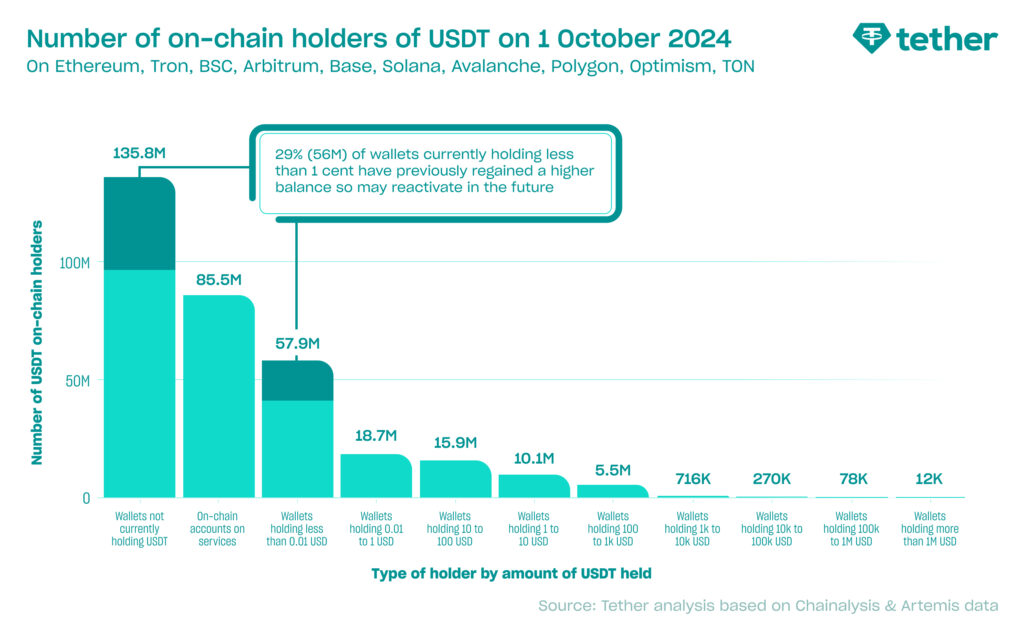

Moreover, reactivation also builds further utility for USDT. Around 29% of the wallets holding less than one cent get reactivated, with the wallet holders mainly using them to pay recurring payments. Along with wallets holding current balances, the potential count of active wallets reaches 165 million.

According to the report, USDT is dominated by smaller balances, as 18.7 million wallets hold somewhere between one cent and one dollar; in emerging markets, this is a sizeable chunk of value for the users. Larger balances within the bracket of $1 and $1,000 are increasingly being stashed for long periods. Just over one million wallets hold upwards of $1,000, showing high variation in user demographics.

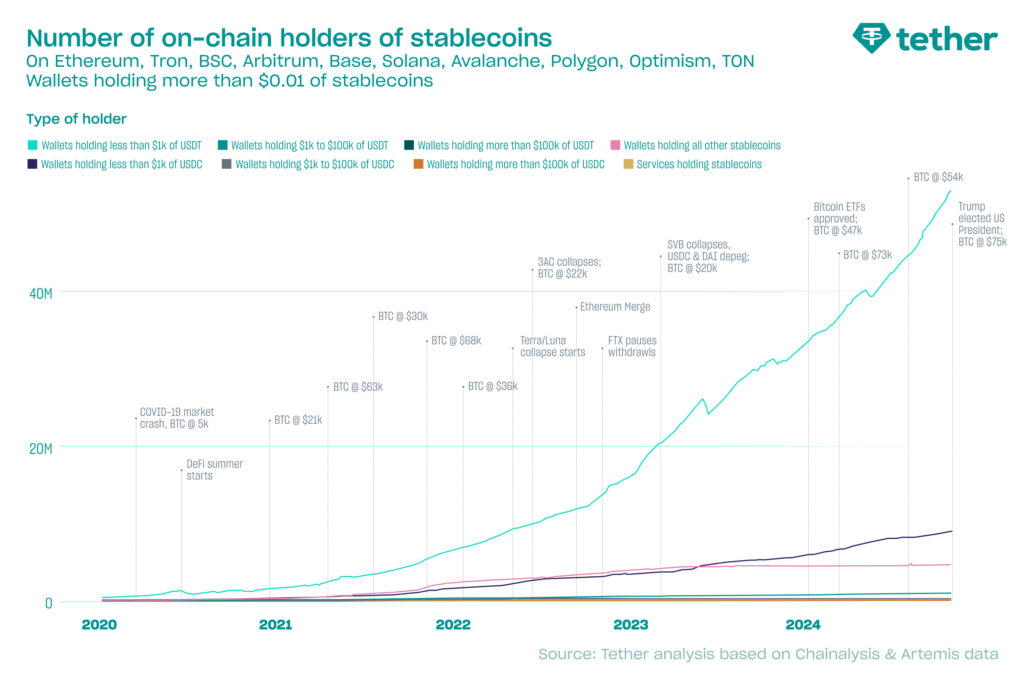

USDT outpaces competitors in stablecoin wallets

It is doing so 4x over its competitors combined for the number of wallets. In total, 54 million on-chain wallets have more than one cent of USDT. The same applies to only 13.8 million of all other stablecoins combined as of Nov. 1. A total of 25 stablecoins across 10 blockchains make up the competitors’ figure.

However, wallet growth for USDT rose 71% this past year alone, buoyed by self-custody trends after the FTX collapse and other major platform collapse. Even while rivals faced setbacks, it managed to hold its position as the global stablecoin of choice.

Related | Pavel Durov appears in French court over allegations regarding Telegram