The tokenization of real-world assets surged in the first half of 2025. The growth was driven by clearer regulations that encouraged wider use of blockchain-based financial products.

Real-world asset tokenization means creating digital versions of physical or financial assets on a secure blockchain, making it easier for people to invest in and trade them.

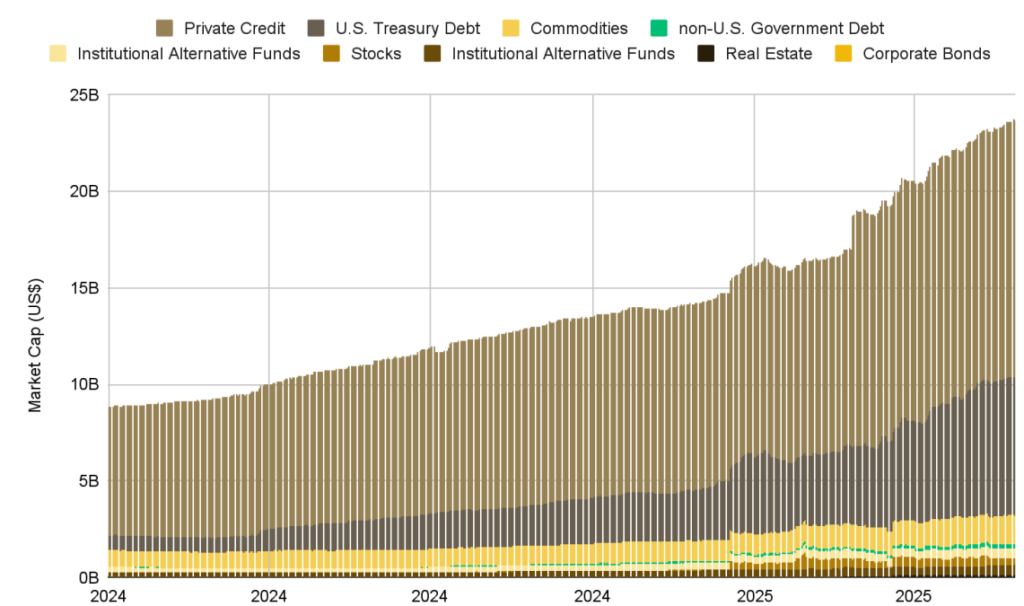

The RWA market surged more than 260% in the first half of 2025, reaching over $23 billion in value. At the start of the year, it was at $8.6 billion, according to a Binance Research report.

Tokenized private credit led the RWA market boom, making up about 58% of the market, followed by tokenized US Treasury debt at 34%. The report said:

As regulatory frameworks become clearer, the sector is poised for continued growth and increased participation from major industry players.

Bitcoin stability drives RWA adoption

The US Securities and Exchange Commission (SEC) views RWAs as securities and hasn’t issued specific regulations for them. However, the industry still benefits from new rules in the broader crypto space.

On May. 29, the SEC released new guidance on cryptocurrency staking, which many viewed as a step toward clearer and more practical regulation.

Alison Mangiero, head of staking policy at the Crypto Council for Innovation, called it a major win for the industry. The industry is waiting on the full Senate to vote on the GENIUS Act. It aims to set clear rules for backing stablecoins.

Other analysts pointed to Bitcoin’s brief periods of price stability as the main reason behind the RWA market’s growth, as a safer investment with more predictable returns.

Corporate FOMO fuels Bitcoin buys

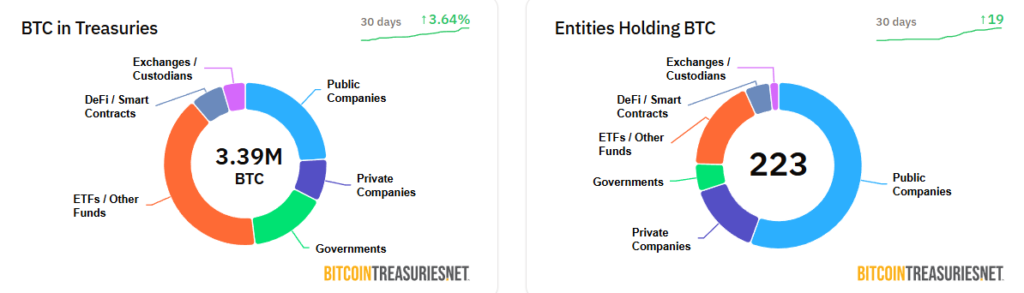

A renewed corporate “FOMO” fear of missing out is driving more and more companies to add Bitcoin to their balance sheets. At least 124 public companies now hold Bitcoin as part of their corporate reserves, according to data from BitcoinTreasuries.NET.

Summer might slow down overall crypto activity. However, the pace of corporate Bitcoin adoption will mostly depend on broader economic trends and regulatory changes.