Friendlier regulations in Washington and the growth of crypto ETFs have lifted the U.S. two spots to second place in global crypto adoption, according to Chainalysis.

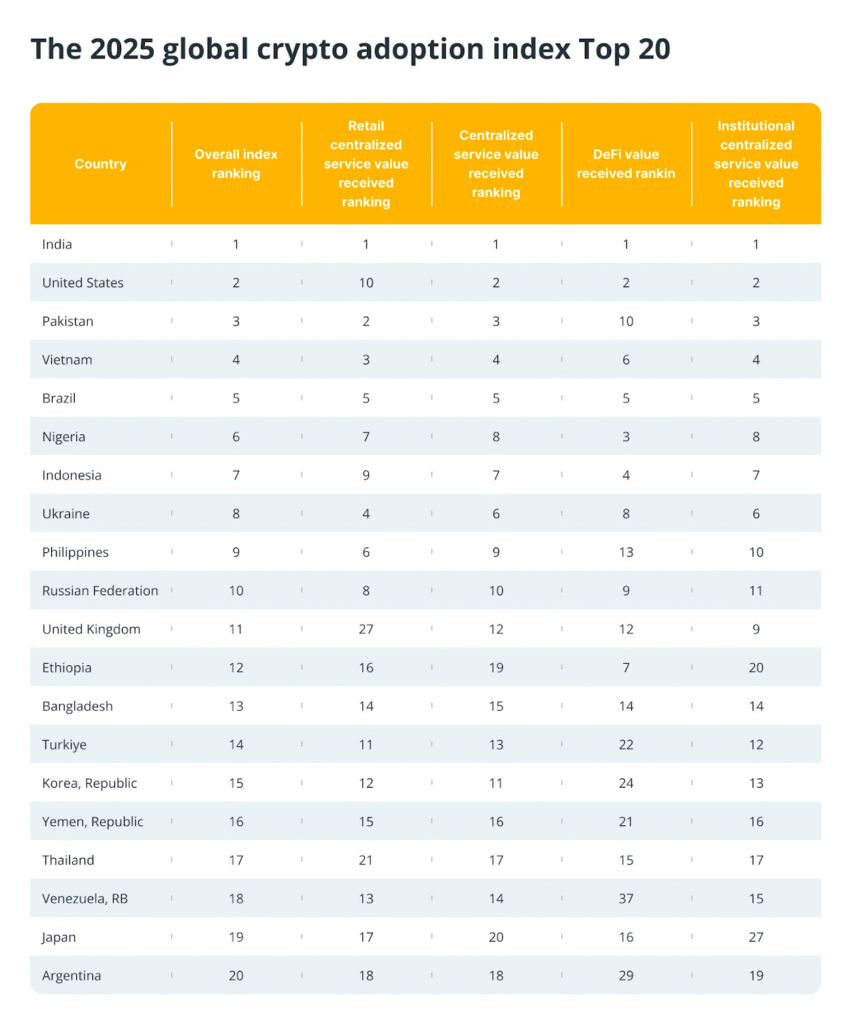

The U.S. trailed only India, which held the top spot for the third year in a row. Their growth helped make Asia-Pacific the fastest-growing region from July. 2024 to June. 2025, Chainalysis said in its 2025 Global Adoption Index released Wednesday.

Stablecoins power emerging market growth

Chainalysis chief economist Kim Grauer said crypto adoption is rapidly growing in developed markets with clearer regulations and institutional support, as well as in emerging markets where stablecoins are transforming how people manage money. He added:

The biggest driver of this adoption is utility: whether it’s stablecoins used for remittances, savings in inflation-prone economies, or decentralized apps meeting local needs, people adopt crypto when it solves real problems.

Pakistan made one of the biggest leaps, rising six spots to third place, while Vietnam and Brazil completed the top five. Nigeria fell from second to sixth place despite some regulatory progress over the past year, with Indonesia, Ukraine, the Philippines, and Russia filling out the top 10.

The overall rankings factored in four categories that measured the crypto value received by retail users and institutions through both centralized and decentralized services.”

U.S. rises to 2nd in crypto adoption

The US climbed from fourth to second place in Chainalysis’ latest report. The growth fueled by stronger spot Bitcoin ETF adoption and clearer regulations that strengthened crypto’s place in traditional finance.

Grauer said clear regulations are especially important for big companies and traditional financial institutions, since compliance, legal issues, and reputation are top priorities.

Farside Investors reports that U.S. spot Bitcoin ETFs have attracted $54.5 billion in inflows since launching last January, with the bulk of it coming between last June and this July.

Investment advisers picked up $1.3 billion worth of spot Ether ETFs in the second quarter, while hedge funds bought about $687 million, Bloomberg reported last month.