The Trump family-backed crypto platform World Liberty Financial (WLFI) plans to airdrop a small amount of its new US dollar-pegged stablecoin as a reward for early WLFI holders and to test its airdrop system.

According to the May. 6 proposal in the WLFI governance forum, with over 99% of votes in favor, the airdrop will distribute around USD1 to eligible WLFI token holders. Further, the proposal states:

Testing the airdrop mechanism in a live setting is a necessary step to ensure smart contract functionality and readiness. This distribution also serves as a meaningful way to thank our earliest supporters and introduce them to USD1.

The exact amount of USD 1 is yet to be decided. However, the amount will depend on the total number of eligible wallets and the budget, as outlined in the proposal. The date for the airdrop is still pending.

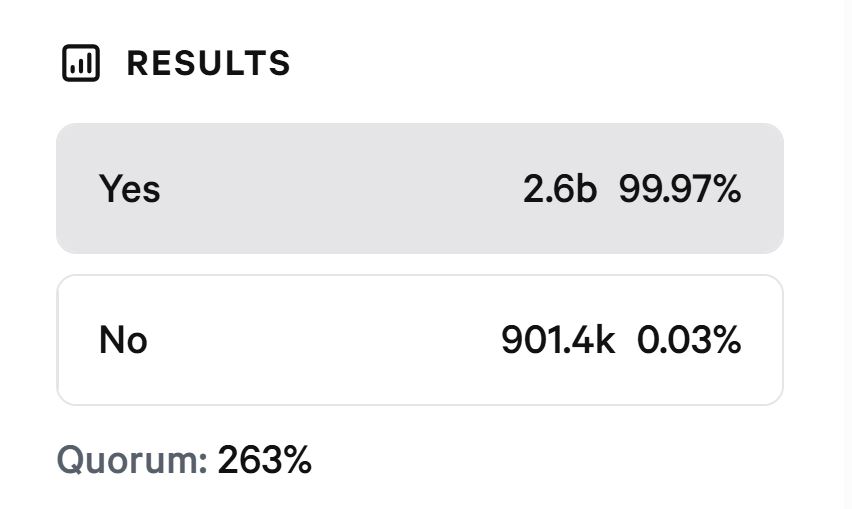

WLFI airdrop vote: Majority in favor with 99.97%

WLFI stated that it reserves the right to cancel, suspend, modify, or end the test airdrop at any time. The vote is set to close in May. 14, and so far, those in favor are leading with 2.6 billion tokens, accounting for 99.97% of the total. Those opposed have cast about 901,000 tokens, or 0.03% of the vote.

WLFI introduced its stablecoin in early March. Since launching the platform in September, the crypto company has held two public token sales. The token sales raised a total of $550 million from 85,000 registered holders.

The market value of U.S. dollar-backed stablecoins surpassed $230 billion in April, according to a report from investment bank Citigroup. This marks a 54% increase from last year, with Tether and USDC dominating 90% of the market.