Binance has filed a request to dismiss a $1.76 billion lawsuit from the FTX estate. The company claimed the failed crypto exchange is trying to avoid responsibility for its downfall.

Binance’s legal team, responding to the suit filed on May. 16 in Delaware Bankruptcy Court, called it “legally deficient.” They said FTX’s collapse was caused by internal issues, not market manipulation or hostile actions.

Plaintiffs are pretending that FTX did not collapse as the result of one of the most massive corporate frauds in history.

FTX’s estate says Binance received billions in crypto during a 2021 buyback deal that was improperly funded with customer assets. BNB rejects the claim. The firm explained that “FTX continued operating for 16 months” after the share buyback and that there was “no reasonable basis” to believe the exchange was insolvent at that time.

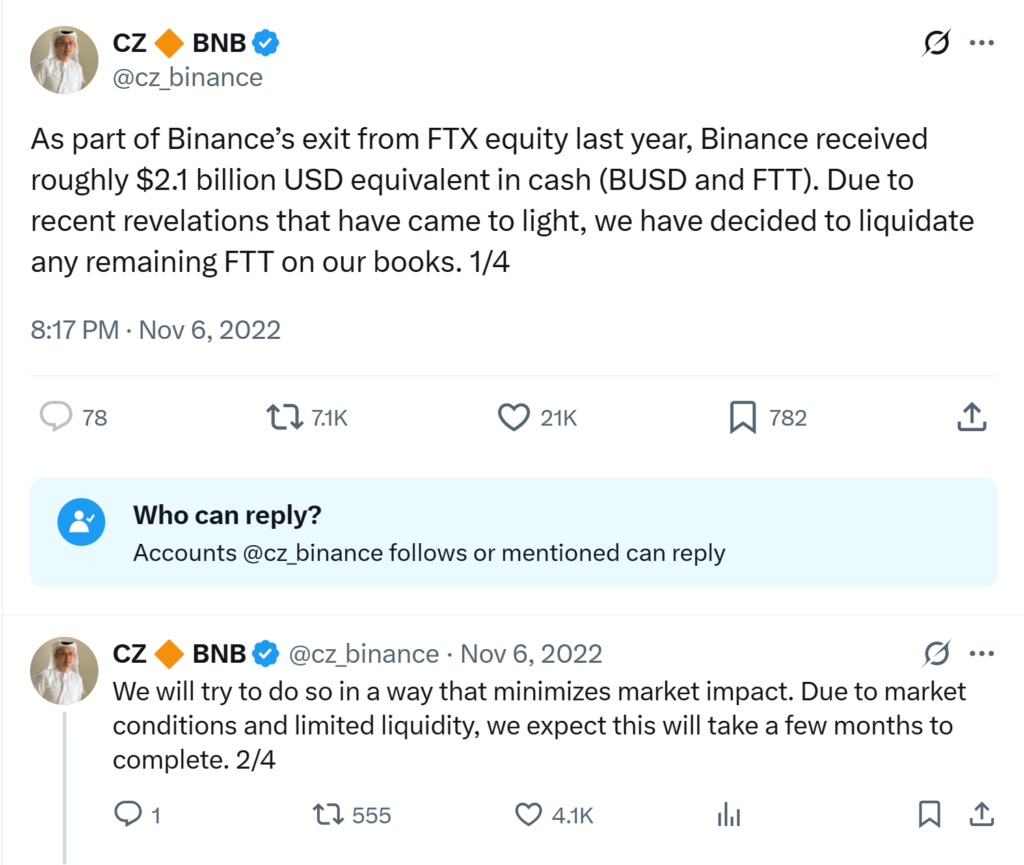

The lawsuit also accuses former Binance CEO Changpeng Zhao sparked the collapse with a tweet on Nov. 6, 2022. He announced the liquidation of FTT tokens.

Binance rejects FTX allegations, cites lack of jurisdiction

Binance said that Zhao’s tweet was based on public concerns. They explained that their decision to sell off the remaining FTT follows “recent revelations.” The Nov. 2, 2022 CoinDesk article that revealed Alameda Research’s financial situation.

The company also defended Zhao’s remark that Binance intended to minimize market impact. Additionally, they said “The Complaint doesn’t include any facts” to suggest BNB had no plans to follow through.

Binance challenged the court’s jurisdiction, saying that none of the foreign entities named are incorporated or have their main business operations in the United States, so the court doesn’t have authority over them.

The filing also describes the plaintiff’s story as a jumble of state law claims based largely on speculation, much of it coming from the hindsight of a convicted fraudster. Binance has asked the court to dismiss all claims permanently. The FTX estate hasn’t responded yet.