The SportsFi leader Chiliz prepares to bring back its operations to the U.S. crypto space. The company is in discussions with the Securities and Exchange Commission (SEC) as it strives for market entry before the 2026 FIFA World Cup. The strategic operation will invest up to $100 million in a planned move to bring back its operations, along with new strategies for fan engagement in American sports.

Tapping into the FIFA hype and U.S. market potential

The FIFA World Cup produces major public attendance and a heavy media presence. Therefore, the World Cup presents Chiliz with an ideal moment to restart its operations under increased public attention. The market entry aligns well with the rising regulatory clarity for crypto in the United States. The new launch period could optimize company functions while attracting new strategic connections.

Chiliz’s investment will help develop their platform structure and boost fan token popularity. Sports fans who hold digital assets gain improved access to direct team interaction through them. The initiative serves as a dynamic approach to boosting supporter loyalty and developing an involved fan base.

Regulatory classification

For their return strategy, Chiliz must demonstrate successful involvement with the SEC. The company states that fan tokens do not qualify as security assets. If declared a security entity, fan tokens must follow multiple strict regulations and complicated administrative protocols. Therefore, future adoption standards of market fan tokens will originate from this established legal classification.

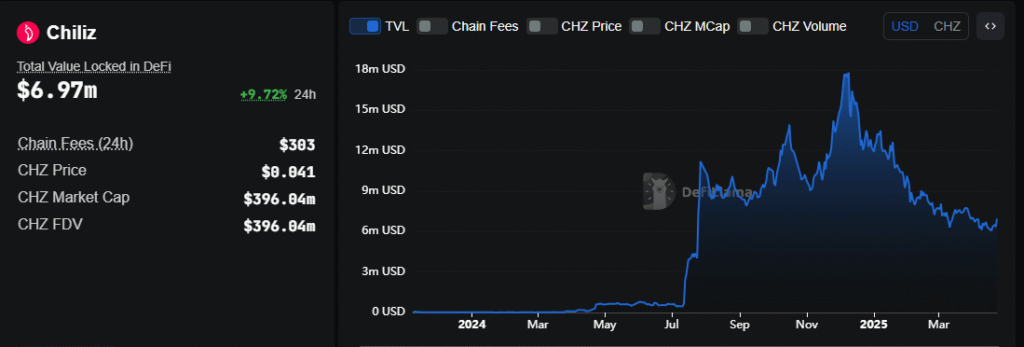

However, Chiliz encounters multiple challenges during its operations. Total Value Locked decreased abruptly based on DeFi Llama reports, dropping from $17.8 million during Dec. 2024 to reach $6.5 million by Apr. 2025. Over the previous year, the token suffered a value decrease of 67% compared to its original value.

Chiliz reinforces blockchain innovation with regulatory standards through its partnership with the SEC’s Crypto Task Force. Chiliz positioning itself through SEC regulatory changes gives it future entry opportunities in the U.S. market. As well as, establishes itself as an example for other cryptocurrency projects. These engagement activities might lead to important changes in upcoming U.S. crypto regulatory policies.