A U.S. federal court has ruled that the Treasury Department’s Office of Foreign Assets Control (OFAC) doesn’t have the authority to bring back sanctions against Tornado Cash. In a ruling on Apr. 28, Austin federal judge Robert Pitman decided that the U.S. Treasury’s sanctions against Tornado Cash were illegal. He also issued a permanent order blocking the government from executing those sanctions.

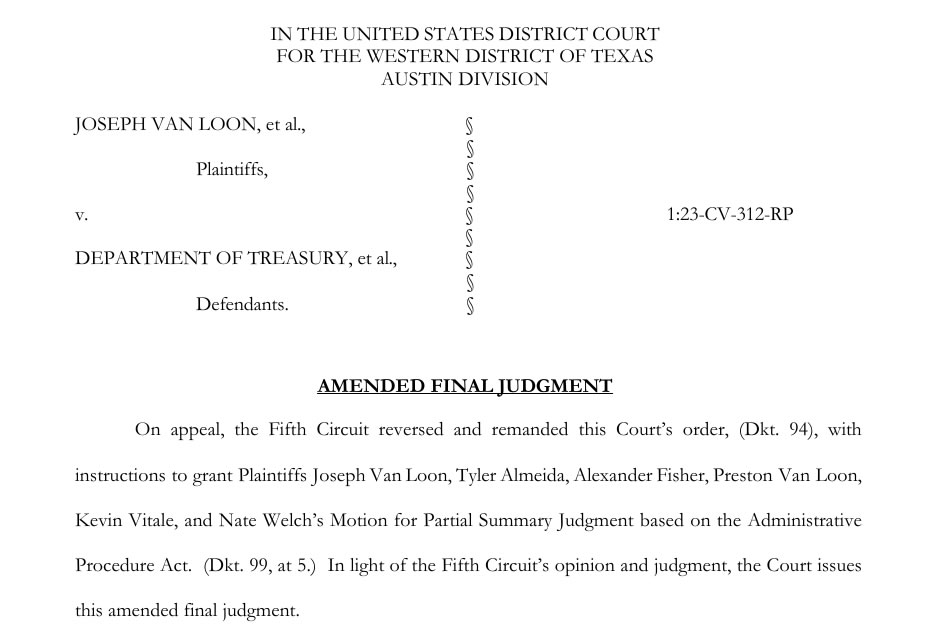

Tornado Cash users, led by Joseph Van Loon, filed a lawsuit against the U.S. Treasury, claiming that the government acted unlawfully when it blocklisted the platform by adding its smart contract addresses to the sanctions list known as the Specially Designated Nationals and Blocked Persons (SDN) list.

In Aug. 2022, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) imposed sanctions on Tornado Cash. They claimed that the firm was helping North Korean hackers, specifically the Lazarus Group.

Tornado Cash ruling limits treasury powers

The agency removed the platform from the sanctions list on Mar. 21 and argued that the issue was no longer relevant after a court sided with Tornado Cash in January. The latest revised ruling stops OFAC from re-imposing sanctions on Tornado Cash or adding it back to the blocklist.

Initially, the court rejected a request for partial summary judgment and ruled in favor of the Treasury. However, the Fifth Circuit later overturned this decision, directing the lower court to grant partial summary judgment to the plaintiffs, which resulted in the sanctions being revoked. In March, the Treasury stated that a final court ruling wasn’t necessary in the lawsuit.

On Apr. 28, the DeFi Education Fund petitioned the White House’s crypto czar, David Sacks, asking him to urge prosecutors to drop the charges against Tornado Cash’s co-founder, Roman Storm. Storm was accused in Aug. 2023 of helping launder more than $1 billion in cryptocurrency through the protocol, and his trial is scheduled for July.

The group said that the Department of Justice was trying to hold software developers criminally responsible for how others use their code. They said this idea was not only ridiculous in theory but also dangerous because it could create a precedent that stifles crypto development in the United States.