Russia’s Ministry of Finance and the Central Bank plan to introduce a crypto exchange for a select group of investors under an experimental legal framework. This move aims to bring cryptocurrency operations out of the shadows and regulate them within the country.

The new trading platform will only let “super-qualified” investors buy and sell cryptocurrencies. These investors will have to satisfy stringent criteria, for instance, having at least 100 million rubles worth of assets or having earned over 50 million rubles in the last year.

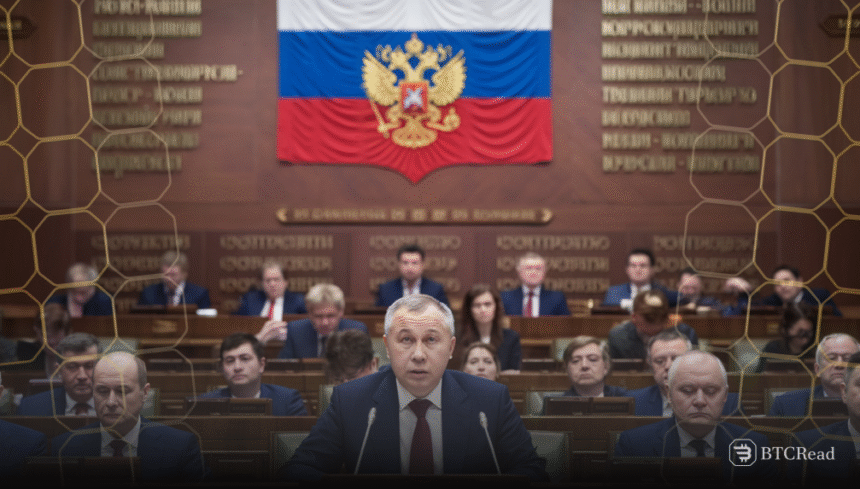

Russia’s crypto trial limits access

The Ministry of Finance has also stated that these requirements for super-qualified investors may shift, with further negotiations likely to refine them. For non-qualifying individuals, there will still be availability to cryptocurrencies, though by way of derivatives based on the value of the cryptocurrency, rather than direct holding.

The derivatives will be available to every qualified investor, not only to those with a super-qualified status. The Central Bank proposed a three-year duration for the experimental legal framework that permits cryptocurrency trading.

Throughout this phase, a limited group of investors will have direct access to trade cryptocurrencies. The Bank of Russia’s proposal is an important move toward a regulated platform for trading cryptocurrencies in Russia.

Vladimir Krekoten, a high-ranking executive at Moscow Exchange, affirmed that the exchange is ready to provide crypto-based derivatives as soon as regulations to support this become available.

Russia sees a divided stance on crypto

He added that this platform is prepared to launch this service by as early as 2025. In like manner, SPB Exchange also voiced support for these projects and is preparing to launch products with associations with cryptocurrency values in the future.

Financial companies and brokers are watching these events very closely. Some are prepared to provide crypto-tied financial instruments once regulations permit it and consider this as a burgeoning market. There are others still, though, who are not very optimistic.

Igor Danilenko from Renaissance Capital criticized cryptocurrencies. He said they lack real collateral and compared them to pyramid schemes. The crypto market keeps growing. Russia’s new rules will likely shape its future. Investors and regulators are watching closely.