A federal court has slapped a New York man with a $36 million fine for allegedly defrauding cryptocurrency investors by promising big returns and using their money to fund his extravagant lifestyle.

In a statement released on Sept. 20, the U.S. Commodity Futures Trading Commission (CFTC) revealed that U.S. District Judge Vince Chhabria ordered William Koo Ichioka to pay $31 million in restitution to the victims of his crypto and forex scam.

Additionally, he was hit with a $5 million civil penalty. The CFTC revealed that Ichioka began his fraudulent scheme in 2018, luring investors by falsely promising them a 10% return every 30 business days. While he promised to invest some of the funds in foreign currencies and crypto, the CFTC claims that Ichioka mixed the investors’ money with his own.

He allegedly used the funds to cover personal expenses, such as paying rent for his home, purchasing jewelry and watches, and buying luxury cars.

Feds take action as crypto scams cost Americans billions

Regions have taken further action over a year after the court first issued a permanent injunction against Ichioka in Aug. 2023. At that time, he was banned from trading in any markets overseen by the CFTC and prohibited from registering with them. Specifically, regulators have been closely monitoring individuals making false promises of high returns in the crypto space.

For instance, on May. 18, the US Department of Justice charged crypto influencer Thomas John Sfraga with wire fraud after he falsely claimed investors could see returns as high as 60% in just three months. In February, the US Securities and Exchange Commission charged crypto trading instructor Brian Sewell for convincing 15 of his students to invest $1.2 million in a hedge fund, promising high returns.

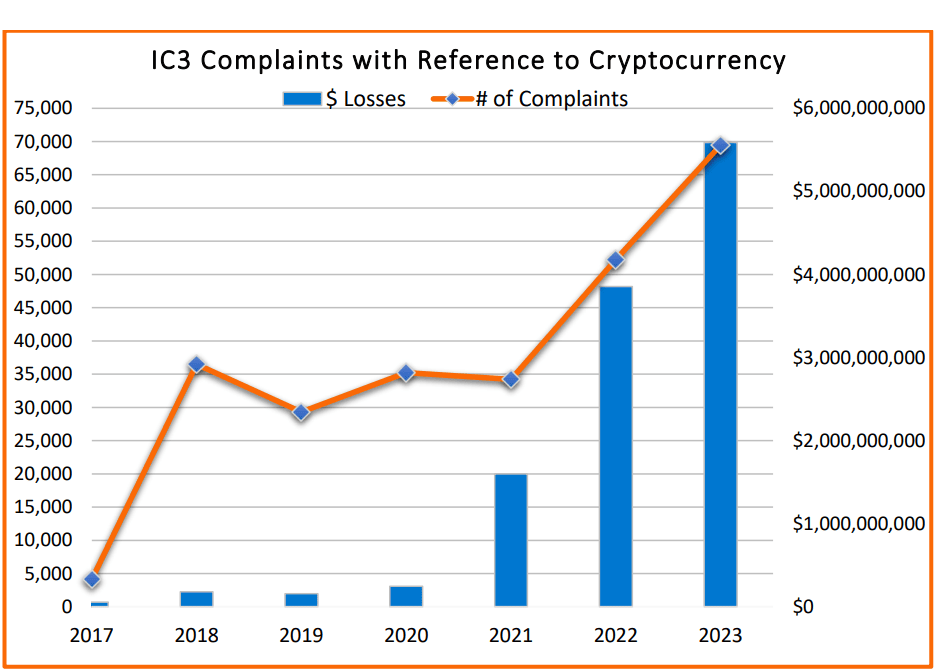

Unfortunately, the amount of money lost to crypto scams keeps growing yearly. On Sept. 9, reports revealed that Americans lost $5.6 billion to crypto fraud in 2023, marking a 45% increase from the previous year. According to the FBI’s Internet Crime Complaint Center, while crypto scams made up just 10% of the total complaints, they accounted for nearly half of the total financial losses during that period.