The FTX bankruptcy estate is pressing forward with lawsuits against various crypto companies as part of its ongoing efforts to recover assets, with Binance being its latest target. According to a complaint filed on Nov. 10, a group of firms tied to FTX’s bankruptcy proceedings has filed a lawsuit against Binance, aiming to recover $1.8 billion.

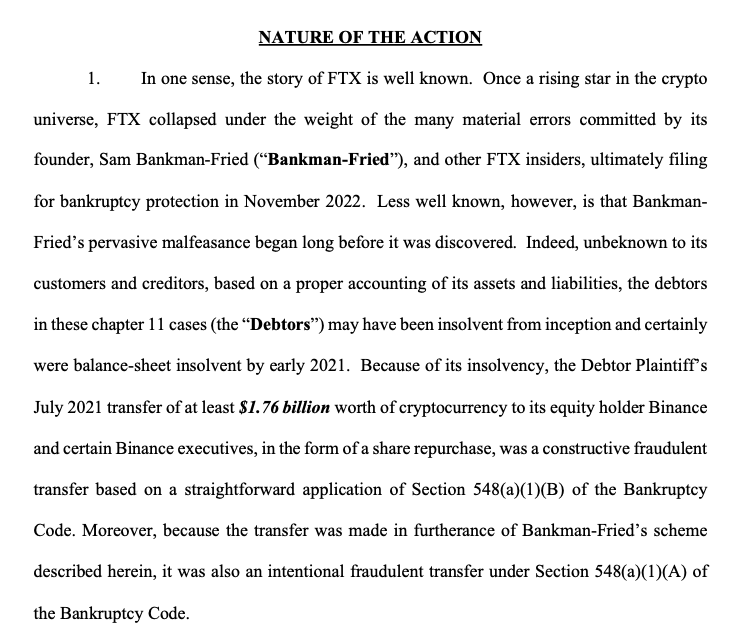

The plaintiffs claim that Binance, along with its former CEO Changpeng “CZ” Zhao and other executives, received at least $1.76 billion in cryptocurrency from FTX through a fraudulent transfer. According to the FTX estate, this questionable transaction traces back to a buyback agreement made in July. 2021 with Sam Bankman-Fried, the FTX co-founder, now serving a 25-year sentence.

FTX’s $1.8B suit against Binance

Bankman-Fried sold about 20% of FTX International and 18.4% of FTX US (also called West Realm Shires Services). The filing reveals he paid for the stock buyback with a combination of FTX’s FTX Token (FTT) and Binance’s BNB and Binance USD (BUSD), valued at $1.76 billion then.

Additionally, the filing argues that FTX and its partner company, Alameda Research, were already bankrupt by early 2021, misleading their share buyback deal.

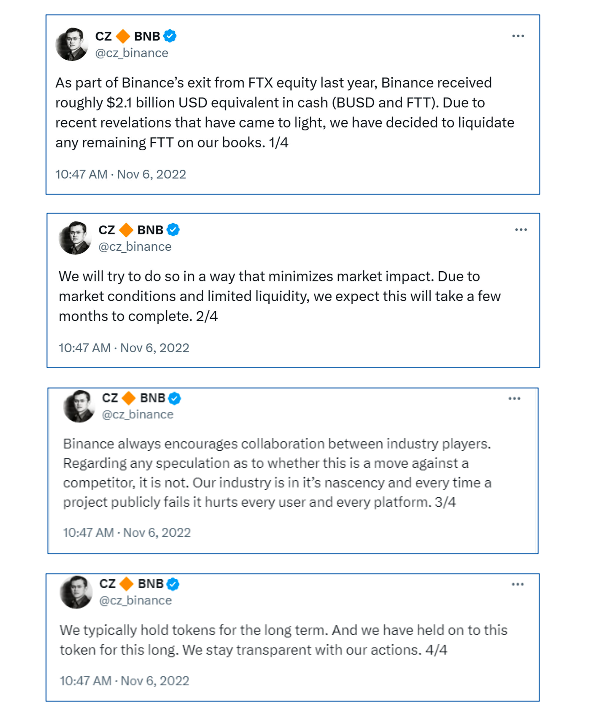

The lawsuit also claims that Zhao led a calculated effort to take down FTX, pointing to Binance’s role in destabilizing its competitor. The filing suggested that FTX believed Binance had been running a “months-long coordinated campaign of fear, uncertainty, and doubt” against FTX in 2022.

An investor connected to Sam Bankman-Fried also told a U.S. Senate hearing that Zhao and Bankman-Fried “were at war with each other, and one deliberately forced the other out of business.” The plaintiffs argued that Binance’s large-scale sale of FTT right before FTX’s collapse in Nov. 2022, along with CZ’s public comments, was a calculated move to undermine FTX and strengthen Binance’s market position.

The FTX estate further claimed that Binance never intended to pursue the proposed acquisition of FTX despite CZ’s statements about it during the liquidity crisis.

Related | Cardano soars amid Trump reelection, faces resistance at $0.65