Italy’s central bank, Banca d’Italia, takes extreme steps to deal with financial risks in the crypto market space. Crypto service providers work with the establishment to create protective measures that defend against financial volatility, cyber threats, and illegal operations. The initiative works to bridge the growing regulatory gaps between EU and US regulations.

The Need for Cohesive Global Regulations

Governor Fabio Panetta appeared at the 31st Assiom Forex Congress on Feb. 15 and emphasized the immediate need for standard regulatory practices. In addition, Panetta declared that regulatory standards differ between US and EU territories. Consequently, illegal operatives take advantage of unmonitored areas.

We need robust safeguards against money laundering and sanctions evasion.

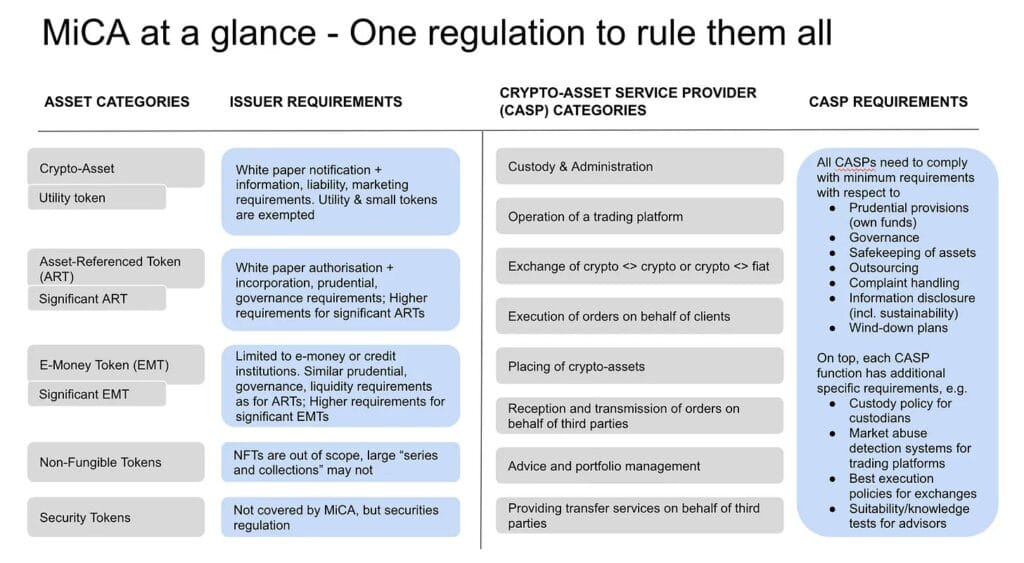

In response, the European Markets in Crypto-Assets (MiCA) framework plans to launch in 2024 to provide combined transparency tools and investor defense systems across European states. An organized framework of regulatory standards does not exist to manage the U.S.A. operating system.

As a result of this, Companies experience added regulatory obstacles in obtaining crypto asset approvals from approval agencies. Moreover, the decentralization of asset approval systems operated by the SEC and CFTC generates additional business barriers.

The Risks of Fragmented Oversight

This regulatory initiative confuses businesses. As a result, the current business risk escalation stems from poor monitoring firms relocating to weak regulatory areas. Market division threatens financial stability. Furthermore, Uneven enforcement fuels volatility.

Hacking attacks on virtual platforms are common to organizations using weak or insufficient cybersecurity protections. Cryptocurrencies are used with anonymous transaction features. Thus, they enhance the risks of money laundering activities.

In particular, Banca d’Italia’s involvement with crypto companies demonstrates the necessity for standardized international financial framework regulations. Concerted regulatory standards will improve investor protection and reduce financial risks linked to fraud and fraudulent market practices. A properly structured framework would help stabilize the cryptocurrency sector’s rapid development.

Italy’s encouraging decisions about crypto regulation serve as a model for international regulatory bodies. Banca d’Italia achieves market transparency through its coordinated efforts between financial institutions and regulatory entities to safeguard market security. Ultimately, cryptocurrency’s developing future depends highly on worldwide work between different entities to secure digital finance’s future.