KuCoin, a worldwide cryptocurrency exchange, faces critical legal investigations from the United States authorities. US authorities filed legal charges against the platform for operating an unlicensed money transmission business in 2024. The platform reportedly undertook billions of suspicious transactions even though it failed to follow basic regulations that required proper KYC and anti-money laundering procedures. The claims brought forward about the exchange initiated prolonged legal procedures that strengthened questions regarding U.S. cryptocurrency regulatory practices.

Regulatory charges and settlement terms

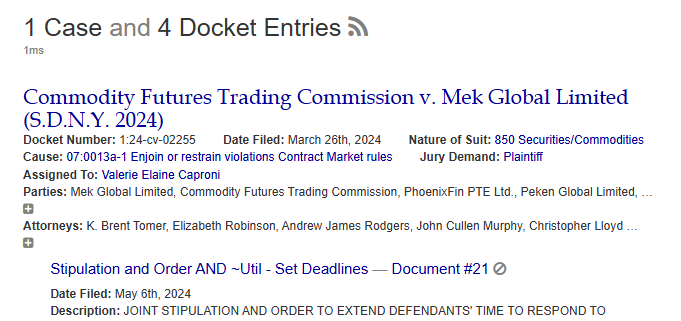

The Commodity Futures Trading Commission (CFTC) took legal action against KuCoin during Mar. 2024. KuCoin received accusations from authorities for violating the Commodity Exchange Act. These were unregistered derivative offerings and inadequate customer identity verification. Investors faced increased danger because the violations violated fundamental federal regulations.

The crypto exchange KuCoin reached a settlement by Jan. 2025. After pleading guilty, the company received penalties surpassing $297 million in total value. After the settlement, the company agreed to stop all U.S. operations for a minimum of two years. The resolution encountered delays during its implementation process. The change in CFTC enforcement policy under Acting Chair Caroline Pham has created obstacles in the approval process. The current voting figures prevent the agency from completing the proposed agreement process.

Jurisdictional disputes and industry impact

Long-standing disagreements between authorities create additional complications for the situation. Pham who serves as Kansas City commissioner argued that the CFTC should not classify KuCoin’s leveraged tokens as digital commodity derivatives. Furthermore, the director warned that such regulatory attempts could diminish the SEC’s authority, which would create problems in understanding financial rules.

KuCoin functions as an important lesson for all crypto enterprises. Regulatory compliance, especially in the U.S., is no longer optional. Fast-growing industrial concerns must execute licensing obligations while running AML and KYC procedures and monitoring regulatory transformations.

The cryptocurrency industry monitors the ongoing legal confrontation against KuCoin as the case progresses. This legal matter creates serious consequences for KuCoin while establishing new regulations for the way U.S. authorities handle digital asset trading platforms. Future actions from enforcement officials and cryptocurrency regulations will probably refer to the outcomes found in this case.