Solana DeFi protocol Loopscale has paused its lending services after getting hit by an exploit that drained around $5.8 million. On Apr. 26, a hacker stole about 5.7 million USDC and 1,200 Solana from the lending platform, Loopscale. Loopscale co-founder Mary Gooneratne explained in a post on X., the attacker pulled it off by taking a series of undercollateralized loans.

Loopscale announced on Apr. 26 through X that it has “re-enabled loan repayments, top-ups, and loop closing.” However, the protocol added that other app features, like Vault withdrawals, are still temporarily unavailable while they continue investigating the exploit and working to fix it.”

Gooneratne said that the hack only affected Loopscale’s USDC and SOL vaults, causing losses of about 12% of the platform’s total value locked (TVL). He added:

Our team is fully mobilized to investigate, recover funds, and ensure users are protected.

Loopscale’s DeFi lending revolution

Hackers exploit over $1.6 billion in crypto from exchanges and smart contracts in just the first few months of 2025, according to a blockchain security firm PeckShield report. Over 90% of those losses can be traced back to a $1.5 billion attack on centralized crypto exchange ByBit.

Loopscale launched its DeFi lending protocol on Apr. 10, following a six-month closed beta. Additionally, the platform aims to enhance capital efficiency by directly connecting lenders and borrowers. Loopscale also mentioned in an April announcement that it supports niche lending markets, including structured credit, receivables financing, and undercollateralized lending.

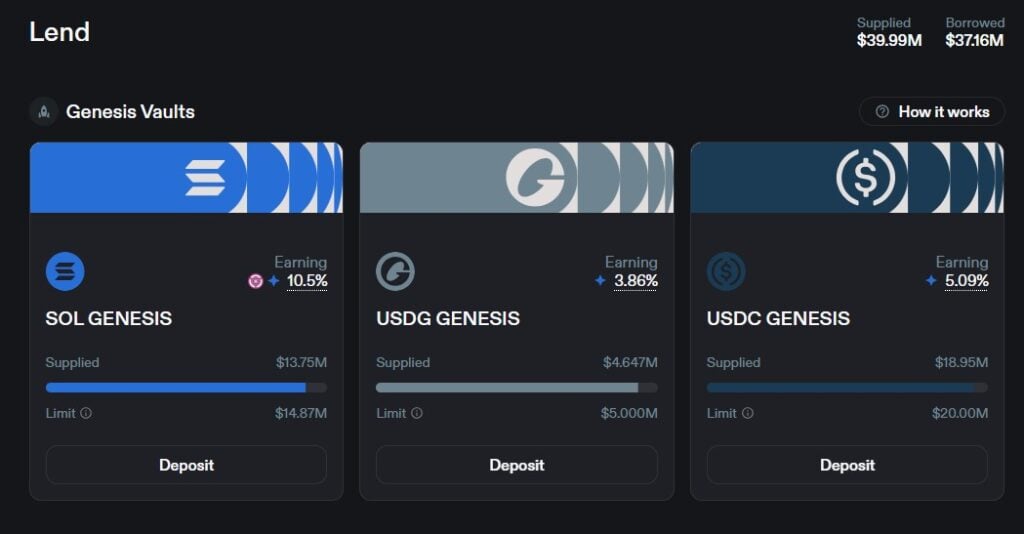

The protocol’s order book model sets it apart from DeFi lending platforms like Aave that combine deposits into liquidity pools. Loopscale offers impressive returns with its main USDC and SOL vaults providing APRs over 5% and 10%, respectively. It also supports lending markets for tokens like JitoSOL and BONK, along with looping strategies for more than 40 different token pairs.

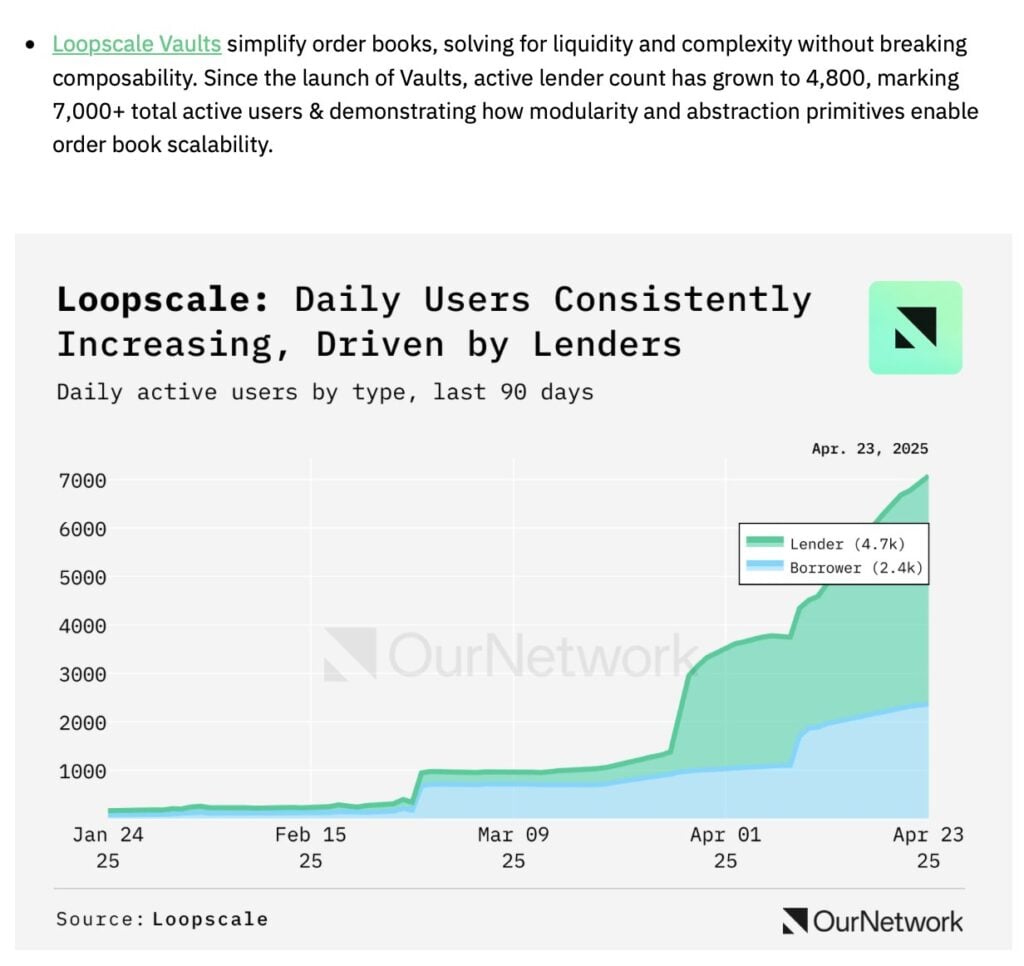

According to researcher OurNetwork, the DeFi protocol currently holds around $40 million in total value locked (TVL) and has gained the attention of over 7,000 lenders.