Major global crypto exchange OKX is reportedly considering a public listing in the U.S. after its return to the country. OKX is planning an initial public offering (IPO) in the U.S., including listing on a local stock exchange, according to a report from The Information on Sunday. The company resumed its operations in the U.S. in April.

From IPOs to crypto treasury stocks, crypto is booming, but the rally is happening in the stock market, with valuations that are surprising even industry veterans, the article’s author, Yueqi Yang, said in a post on X.

Thailand bans OKX amid U.S. IPO plans

In late May, Thailand’s securities regulator, the Thai Securities and Exchange Commission, said it would block OKX from operating in the country, along with four other exchanges: Bybit, 1000X, CoinEx, and XT.COM.

The agency said that the SEC advises all investors on these platforms to take appropriate steps with their assets before the shutdown. An OKX IPO would come after Circle, the company behind the USDC stablecoin, successfully went public.

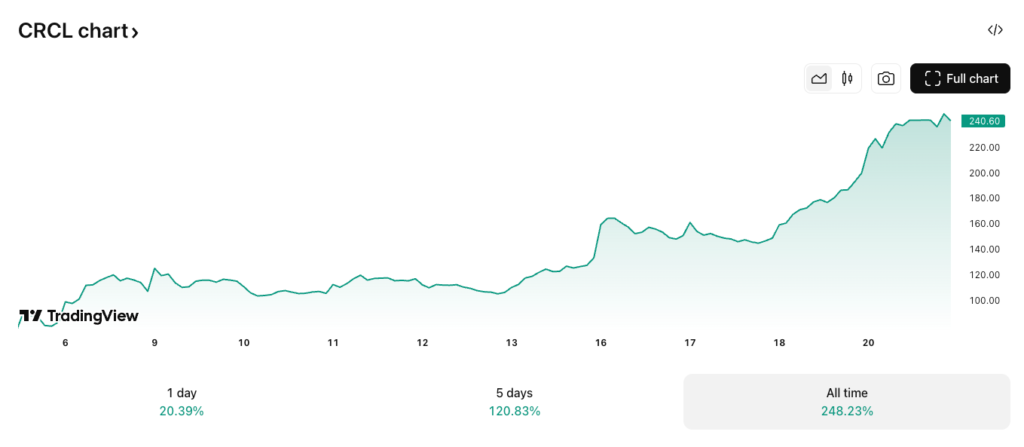

After several IPO increases to meet strong investor demand, Circle shares debuted at $69 on the New York Stock Exchange on June 5. Since then, Circle’s stock (CRCL) has surged nearly 250%, briefly peaking at $248.90 by last Friday.

Circle’s USDC partner, the U.S. crypto exchange Coinbase (COIN), has been publicly listed for over four years since its Nasdaq debut in Apr. 2021.

Coinbase gains 30% as mining stocks still tumbling

Coinbase shares closed at $308.40 last Friday, gaining nearly 30% over the past five trading days, according to TradingView. However, COIN remains down 19% since its initial public offering.

While Circle and Coinbase stocks have risen sharply in recent weeks, some other crypto-related stocks are still facing significant declines.

The largest publicly traded Bitcoin mining U.S company, Marathon Digital Holdings (MARA), saw its stock price fall from $15.60 last Monday to a low of $14.20 on June. 20, according to TradingView.

Other mining companies, like Bitfarms and Riot Blockchain, also followed the downward trend last week, with their shares dropping by 7% and 3.8% over the past five trading days, respectively.