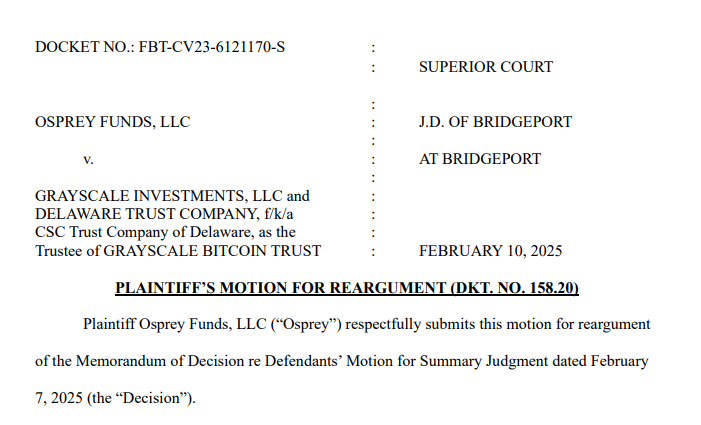

Osprey Funds has taken a decisive step by ETF challenging a Connecticut court’s ruling in favor of Grayscale Investments. The asset manager is seeking a review of the decision that dismissed its $2 million unfair trade lawsuit before full discovery. Osprey contends that the judge misapplied legal standards, unfairly benefiting Grayscale and prematurely ending the case.

The court granted summary judgment to Grayscale, citing an exemption under the Connecticut Unfair Trade Practices Act (CUTPA). The ruling ETF relied on the 1986 Russell case, which held that CUTPA does not apply to deceptive practices in securities transactions.

However, Osprey argues that this interpretation was too broad. The company insists that its case involves unfair competition rather than a securities transaction and, therefore, should not be dismissed under this precedent.

Osprey: Court misapplied CUTPA test in Grayscale case

Osprey’s filing highlights the 1994 Normand Josef case, which established a four-factor test for determining CUTPA exemptions. Osprey asserts that the court failed to apply this test, leading to an incorrect ruling. According to the company, Grayscale did not meet the necessary criteria for exemption, making the judgment legally flawed.

The Connecticut Supreme Court has consistently emphasized that exemptions are not to be extended beyond the legislative intent. As a direct market competitor in the cryptocurrency investment business, Osprey claims that Grayscale engaged in false advertising in order to gain an unfair competitive edge in the market.

Unlike securities fraud claims, which depend on fraudulent sales, Osprey’s claims rest on misleading advertising that allegedly diverted investors. The company argues that false advertising, not securities sales, is the heart of the issue.

The Federal Trade Commission actively enforces regulations against deceptive advertising, including in financial markets. Osprey points to FTC actions against firms making exaggerated investment return claims in securities and cryptocurrency. The company argues that this regulatory approach contradicts the court’s ruling, which wrongly exempted Grayscale from CUTPA.

CUTPA exemptions and their impact on ETF regulation

Legal precedent suggests that CUTPA applies to entrepreneurial activities like advertising. The Connecticut Supreme Court has ruled that exemptions apply only when alternative legal frameworks exist. Since no securities laws directly govern unfair competition between investment firms, Osprey maintains that CUTPA should apply to this case.

By stretching a broad exemption aimed at securities sales to include deceptive advertising, the court’s ruling sets an ominous precedent, Osprey claims. It has the effect of creating a loophole where deceptive marketing in financial markets will be allowed to circumvent scrutiny, it says.

Yet the company argues that full discovery is necessary to offer proof of the purported Grayscale deceptive practices. The Connecticut judge now faces a crucial decision: whether to uphold a ruling that shields financial companies from scrutiny or allow a full investigation of the claims.