The U.S. Securities and Exchange Commission (SEC) recently announced that it had charged Galois Capital Management, a fund adviser, for mishandling client assets. The SEC alleges that Galois failed to appropriately safeguard investors’ funds, including placing them with the now-bankrupt crypto exchange FTX.

The charges point to supposed breaches of the SEC’s custody rule, which requires investment advisers who handle client funds to keep those funds with a trusted custodian, like a registered broker-dealer or bank. The SEC reports that Galois had invested in cryptocurrencies through several online trading accounts, including with FTX Trading Ltd. When FTX collapsed in Nov. 2022, the fund lost about half of its assets.

Co-chief of the SEC’s enforcement division, Corey Schuster, stated that not following custody rule provisions puts investors at risk, making their assets, including cryptocurrencies, vulnerable to loss, misuse, or theft.

US custodians thrive as FTX faces bankruptcy

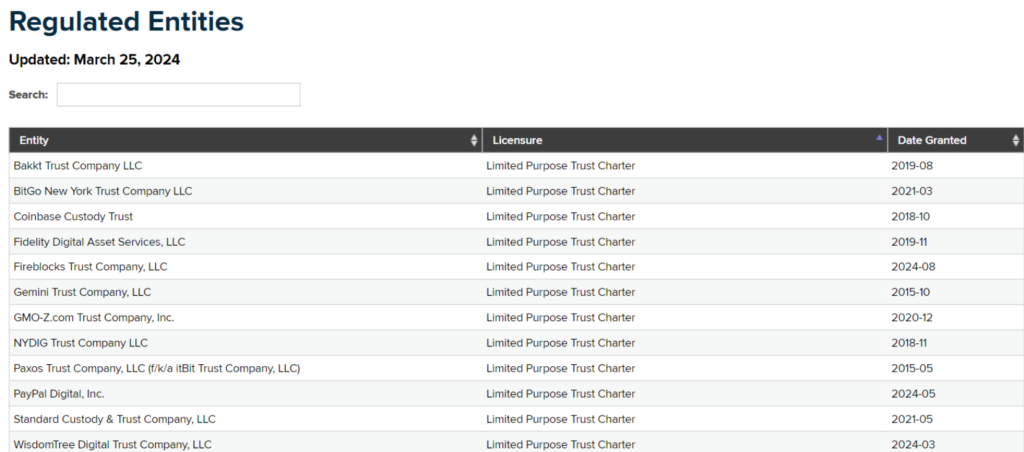

Since 2021, the U.S. has seen a rise in reputable digital asset custodians, like Fireblocks Trust Company, Anchorage Digital Bank, Fidelity Digital Asset Services, and Coinbase Custody Trust. However, the Bahamian crypto exchange FTX wasn’t among them. FTX collapsed in Nov. 2022 after facing a major liquidity crisis and accusations of mismanagement and fraud.

As a result, billions of customer funds became inaccessible, and the company filed for bankruptcy. The agency also claims that Galois misled fund investors about how much notice they needed to give before withdrawing their money.

According to the SEC, the fund adviser told some investors they had to provide at least five business days’ notice before the end of the month while letting others withdraw with less notice. The SEC announced that Galois has agreed to pay a $225,000 fine, which will be paid to investors affected by the fund’s actions.

Related | North Korean hackers target crypto industry: FBI warns