Kraken faced a surge in regulatory data requests in 2024. The crypto exchange reported a 39% increase compared to previous years. Most requests came from U.S. agencies (SEC), with the FBI leading the list.

According to the report, the company remains committed to compliance while protecting user privacy. It operates in over 190 countries and cooperates with law enforcement worldwide. Kraken ensures that all legal requests align with regulations and internal policies.

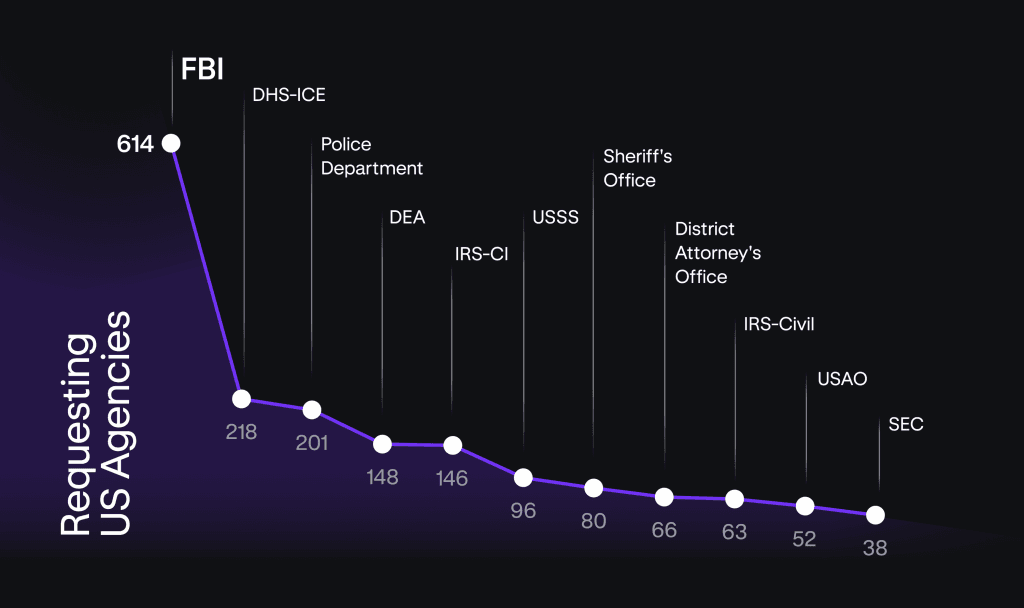

Last year, Kraken received 6,826 data requests. U.S. agencies issued 1,951 of them, making up the largest share. The FBI alone submitted 614 requests, making it the most active agency. Most inquiries came from law enforcement rather than regulatory bodies.

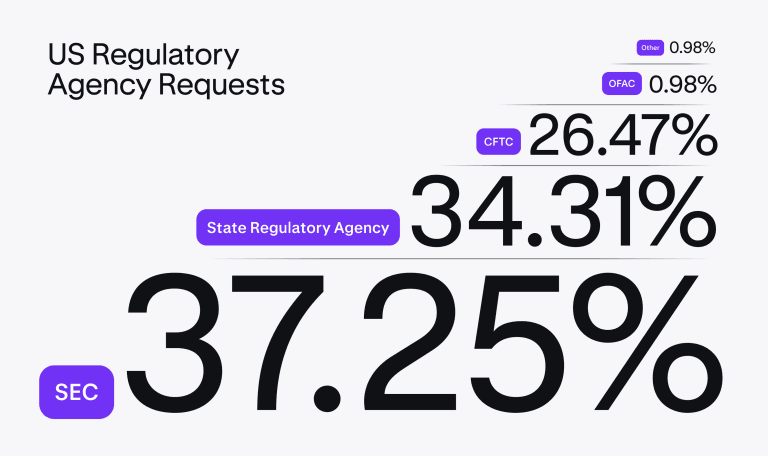

SEC accounts for 37.3% of U.S. regulatory requests

Regulatory agencies also requested data. Although the SEC accounted for only 1.9% of total U.S. agency requests, it was responsible for 37.3% of all U.S. regulatory requests. Authorities sought data for 10,369 accounts, with U.S. clients most affected. Users from the U.K. and Germany followed closely behind.

Kraken’s transparency in handling SEC requests

Kraken follows strict policies when handling these requests. It ensures compliance with laws while safeguarding client privacy. The company employs a team of AML experts, attorneys, and former law enforcement officers. Their job is to evaluate requests carefully before taking action.

Security remains a priority for Kraken. The company continuously strengthens its measures to protect user information. It has built a security framework for over a decade led by top industry experts. The goal is to prevent unauthorized access and data breaches.

SEC regulations and crypto investment risks

Kraken also warns users about crypto risks. It does not influence market prices or provide investment advice. Regulations differ across regions, and not all crypto products have government protection. The company reminds users that digital assets are volatile and could lead to financial losses. Taxes may apply, and investors should seek independent financial advice.

Despite growing regulatory scrutiny, Kraken stays transparent about its compliance efforts. It works with authorities while promoting financial freedom. The exchange remains committed to balancing regulatory requirements with user rights.