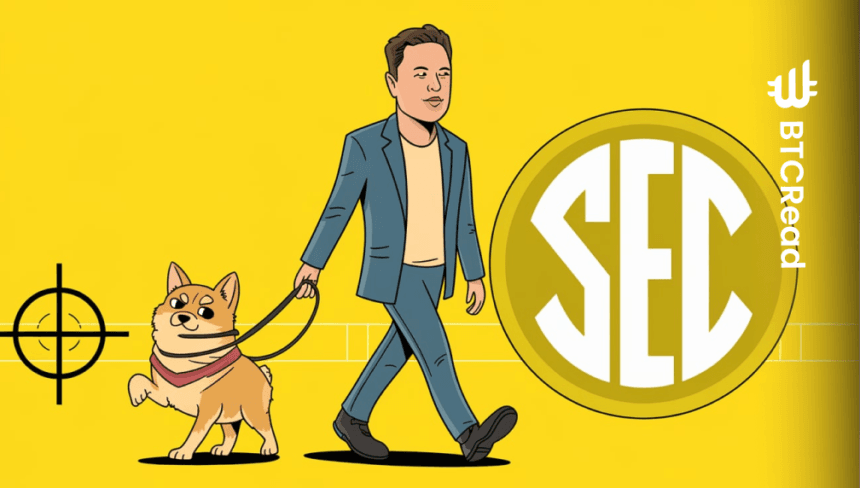

The U.S. Department of Government Efficiency, led by Elon Musk, is aiming for the U.S. SEC. For years, Musk has had a tense relationship with the SEC, often clashing with the agency over regulatory matters. Now, his cost-cutting initiative could change how it operates.

The Musk-led group, known as DOGE, is expected to visit it soon. Sources familiar with the matter say the team is already at the gates of the agency, preparing for their next move. DOGE’s focus on the SEC makes it the latest federal agency to fall under scrutiny.

SEC lawsuit against Musk sparks further tensions

The group, which supports President Donald Trump’s efforts to reduce government spending and regulations, has set its sights on these for a particular reason. Musk’s history with the SEC is no secret. Just last month, the SEC sued Musk for not properly disclosing his stock purchases of Twitter in 2022.

This claims Musk underpaid investors by over $150 million. Musk responded by calling the SEC a “broken organization” on social media.

In recent days, DOGE-affiliated accounts have posted on social media asking for help to uncover waste, fraud, and abuse within this. However, an SEC spokesperson declined to comment on the matter.

A Trump administration official said Musk holds no official role in DOGE’s investigations. The official added that President Trump would address any conflicts of interest. According to White House press secretary Karoline Leavitt, Trump can fire anyone in his administration and is committed to avoiding any conflicts involving Musk.

Democrats warn of security risks with DOGE involvement

The SEC is currently led by acting Chair Mark Uyeda, but that could change if Trump’s pick, Paul Atkins. The future of the SEC remains uncertain as DOGE’s team looks for potential areas to cut costs. Meanwhile, Democrats are concerned about the group’s access to sensitive SEC data.

Last week, Rep. Maxine Waters and Rep. Brad Sherman sent a letter warning that allowing Musk and DOGE access to these systems could put vital financial data at risk. They specifically pointed to the Consolidated Audit Trail, which tracks trading across U.S. markets. The lawmakers argued that giving Musk access to this data could undermine the security of American markets.