The US Securities and Exchange Commission’s (SEC) new guidance on cryptocurrency staking is widely viewed as a major victory for the crypto industry. It is also a significant move toward consistent global regulation of digital assets.

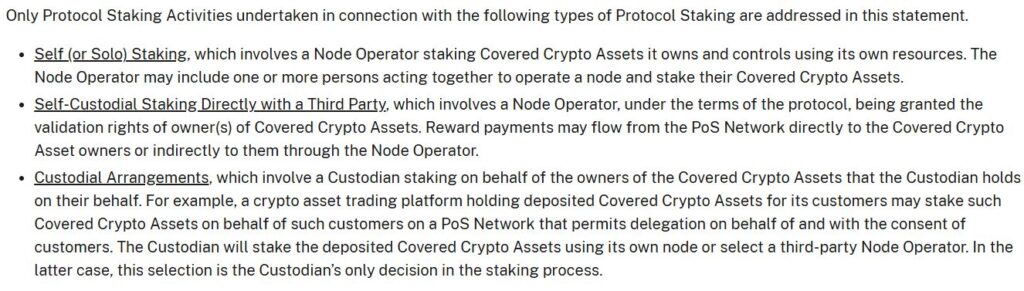

The SEC’s Division of Corporation Finance said on May. 29 that “Protocol Staking Activities,” like staking cryptocurrencies on proof-of-stake blockchains, don’t need to be registered as securities transactions with the Commission.

Head of staking policy at the Crypto Council for Innovation, Alison Mangiero, said that the agency’s new guidance is a major step forward for the US cryptocurrency industry. Crypto industry followers have long called for clearer guidelines on staking.

“Win for stakers,” but ETF approval pending

In April, the CCI’s Proof of Stake Alliance led a group of nearly 30 organizations to send a detailed letter to the SEC’s Crypto Task Force. They outlined that staking services, whether custodial or non-custodial are different from investment contracts.

“The SEC has opened the door to more sensible regulation,” said Mangiero. Further, it added that this is a “win for stakers and the broader crypto community.”

However, industry insiders are still waiting for approval of the first Ether-staking ETFs. On May. 21, the SEC postponed its decision on Bitwise’s application to add staking to its Ether ETF, along with its ruling on Grayscale’s XRP ETF.

RedStone exec praises SEC’s staking guidance

The co-founder and COO of blockchain oracle company RedStone, Marcin Kazmierczak, said the SEC’s new guidance is a notable change from their usual focus on strict enforcement. The SEC created a special Crypto Task Force on Jan. 21. The task force marked another move away from its earlier enforcement-focused approach.

The task force, led by Commissioner Hester Peirce, will release its first report on regulations within the next few months, SEC Chair Paul Atkins said during a hearing on May. 20.

Moreover, the new guidance follows years of CCI’s Proof of Stake Alliance working to educate policymakers about why cryptocurrency staking is important.