Decentralized finance protocol, Veda, has raised $18 million to speed up the adoption of its vault platform. It allows asset issuers to create cross-chain yield products, including interest-earning stablecoins.

The company announced on Monday that CoinFund led the latest funding round, with support from several other investors, including Coinbase Ventures, Draper Dragon, BitGo, Mantle EcoFund, GSR, Credit Neutral, Animoca Ventures, Relayer Capital, PEER VC, Neartcore, and Maelstrom.

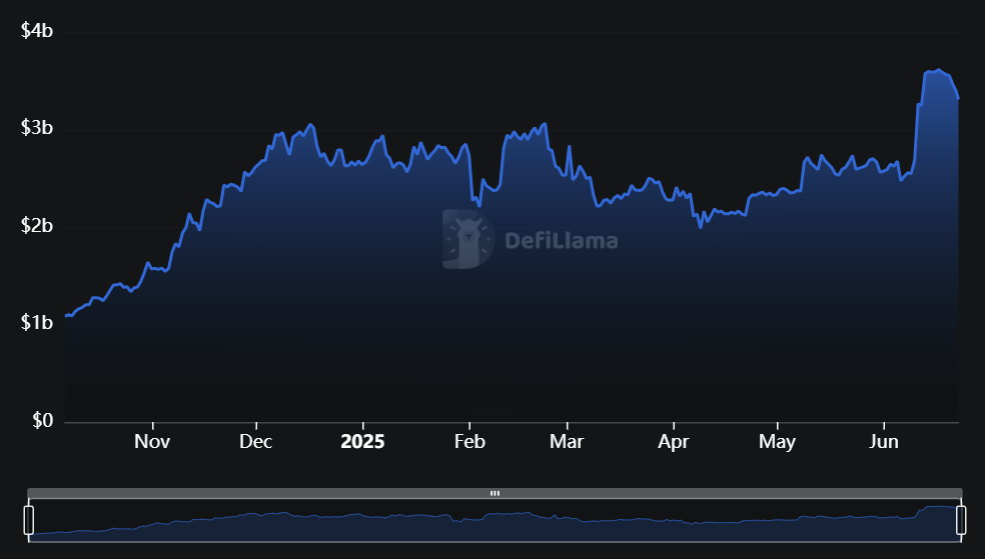

Veda taps Bitcoin yield with $3.3B in locked assets

Veda, launched in 2024, is a protocol that enables tokenization across a variety of DeFi applications, including liquid staking tokens, interest-earning savings accounts, and stablecoins.

It supports some of the largest vaults in the crypto space, powering platforms like Ether.fi’s Liquid, Mantle’s cmETH, and the Lombard DeFi Vault.

Veda now has over $3.3 billion in assets locked, according to DefiLlama data. Moreover, the protocol has recognized a rising interest in generating yield from Bitcoin, despite the challenges involved.

Veda’s co-founder and CEO, Sun Raghupathi, said that the demand for reliable Bitcoin yield is high, but earning even a modest return is often complicated and time-consuming. The protocol is addressing this challenge by partnering with Lombard, the developer of liquid-staked Bitcoin on Babylon.

The rise of yield-bearing stablecoins

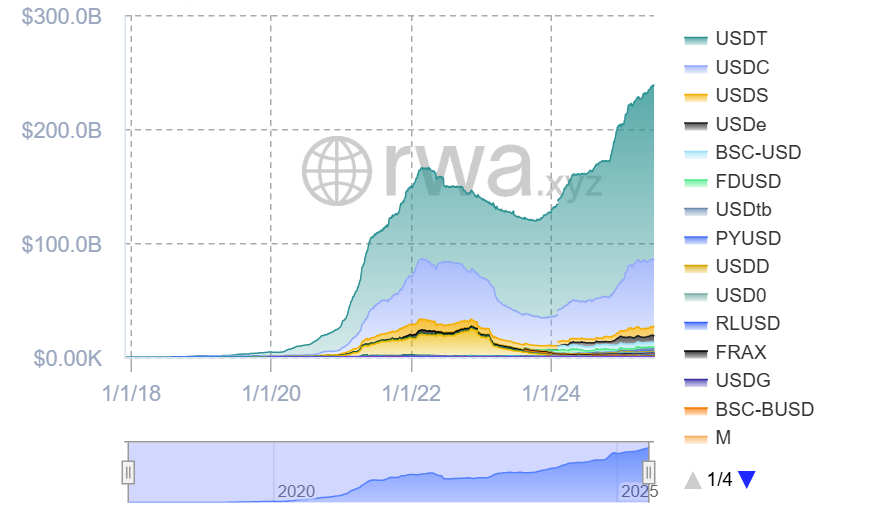

CoinFund’s investment in Vera reflects its growing belief that stablecoins are gaining attention and driving more wealth onto the blockchain. CoinFund’s managing partner and head of venture investments, David Pakman, said:.

The natural next step for wealth onchain is to earn yield and to make your assets (fiat currency or digital assets) productive.

When asked about the rise of yield-bearing stablecoins, which reportedly unsettled the traditional banking lobby, Pakman called them inevitable. Moreover, he said they offer a more reliable way to earn low-risk returns on fiat money than traditional savings or money market accounts.

Circle CEO Jeremy Allaire recently said that stablecoins are nearing mainstream adoption, predicting these assets will soon have their “iPhone moment.”