Ethena’s roadmap to 2025 is clear: in the first quarter, it will start onboarding traditional financial partners who can be onboarded into the iUSDe position. That is a brand new product that connects DeFi with TradFi so that the transition for a legacy finance user will be smooth.

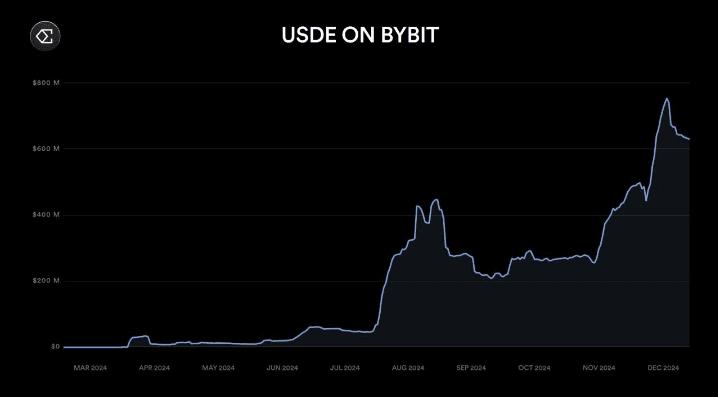

First off, Ethena totally killed it in 2024: it became the third-biggest USD asset in crypto in under a year, with more than $6 billion in supply. The Ethena monthly run rate exceeded $1.2 billion last month. Ethena has emerged as one of the key building blocks for other financial protocols. It even flipped USDC in less than a month on Bybit-testament to its rapid adoption.

According to the Ethena team, the biggest opportunity ahead is in the fixed-income markets, valued at more than $190 trillion. A future of finance means the integration of crypto assets such as the iUSDe into those markets. With interest rates easing, traditional finance is ready to move toward dollar-denominated products like the iUSDe. This will spur the massive growth of Ethena.

Introducing iUSDe: A regulated DeFi product for TradFi

iUSDe will launch as a new product and represent a regulated version of sUSDe. It will work within traditional financial frameworks while still allowing for the yield benefits of crypto assets. Ethena intends to bring this product to a massive audience in partnership with asset managers, private credit funds, and other financial entities.

The timing couldn’t be better for introducing iUSDe. In a world where traditional finance is looking for alternatives for fixed-income products yielding only low returns. iUSDe offers a pretty good solution. It offers yields higher than what can be currently earned. Ethena’s model uniquely positions it to do this and is likely to feature in most fixed-income portfolios.

Among others, the expansion is ongoing into the ecosystem of the iUSDe initiative. In 2025, the platform will launch a Telegram app that will enable users to send, spend, and save using sUSDe. Hence creates a mobile neobank-like experience. Such integration will grant Ethena direct access to more than 900 million users, at an incomparable scale.

Indeed, the future looks bright for Ethena. It is well-positioned and stands a good chance of changing how dollars will be utilized both in crypto and traditional finance. Equipped with iUSDe and other innovations, this platform is about to grow its ecosystem and cement a leading position within the financial space. Convergence between DeFi, CeFi, and TradFi has just begun.