As a decentralized cross-chain liquidity protocol, THORChain has temporarily stopped the lending and saver programs involving the two largest cryptocurrencies, Bitcoin and Ether. The move is to protect LPs and keep stability within the network.

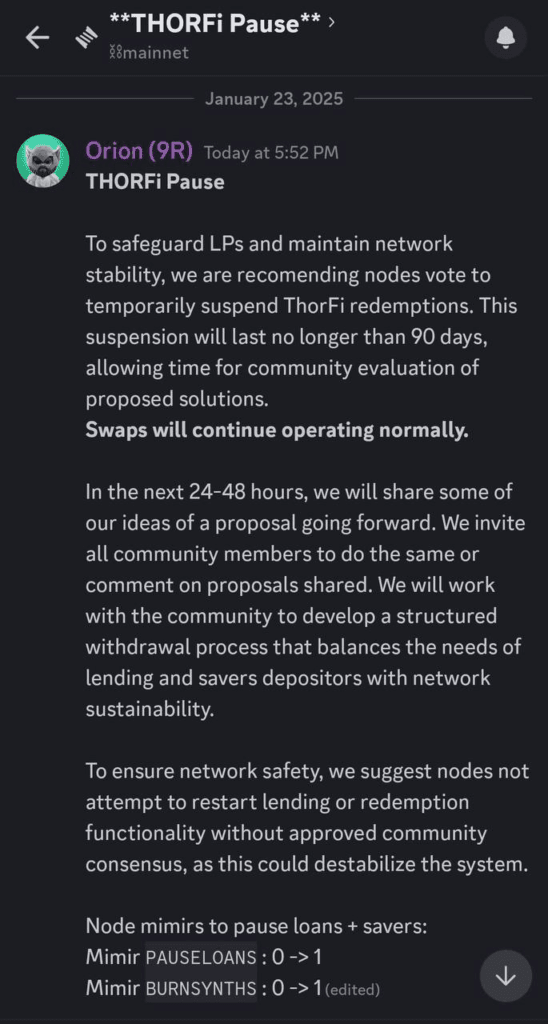

The vote came in after Orion, a THORChain pseudonymous developer, posted in a Discord update. Orion called for nodes to vote to pause ThorFi redemptions for as long as 90 days. This shall give time for community evaluation and proposal of solutions. Orion assured that swaps remain operational, and further ideas will be shared within 24-48 hours.

In his message, Orion called for caution: “Nodes should not independently restart lending or redemption functionalities without community consensus, as it may create system instability.” He called on collaboration to establish a withdrawal mechanism that would balance depositors’ needs while keeping the network viable.

Community member comments on THORChain lending pause

Crypto expert Erik Voorhees commented on X, shedding light on the situation. According to Voorhees, lending and savers withdrawals pauses after a node operator vote.

Already a year ago, deposits had completely stopped because of growing risks. He added that these experimental features were too risky and are now frozen, leaving the community to decide on its resolution.

Voorhees then underscored perhaps the most crucial takeaway: high-risk experiments should not take place at base-layer protocols. He added that while THORChain was conservative in its core DEX, its lending and savers programs are a different matter altogether.

Despite the setback, Voorhees remains optimistic about THORChain’s future, praising its cross-chain liquidity pools as a standout achievement in decentralized finance.

Swaps and the liquidity pool activities are running normally, reflecting the strong characteristics of the protocol. It focuses now on building a path ahead with the lessons learned from its experimental features.