Decentralized liquidity protocol THORChain’s node operators approved a proposal to solve its liquidity issues by converting the platform’s defaulted debt into equity.

On Feb. 2, the platform’s node operators approved a proposal that involves converting its defaulted debt into tokens representing equity in the platform.

The THORChain team expressed gratitude. They thanked community members, node operators, and builders for their support. A post acknowledged their dedication during a crucial moment. The platform emphasized the importance of engagement and collective decision-making.

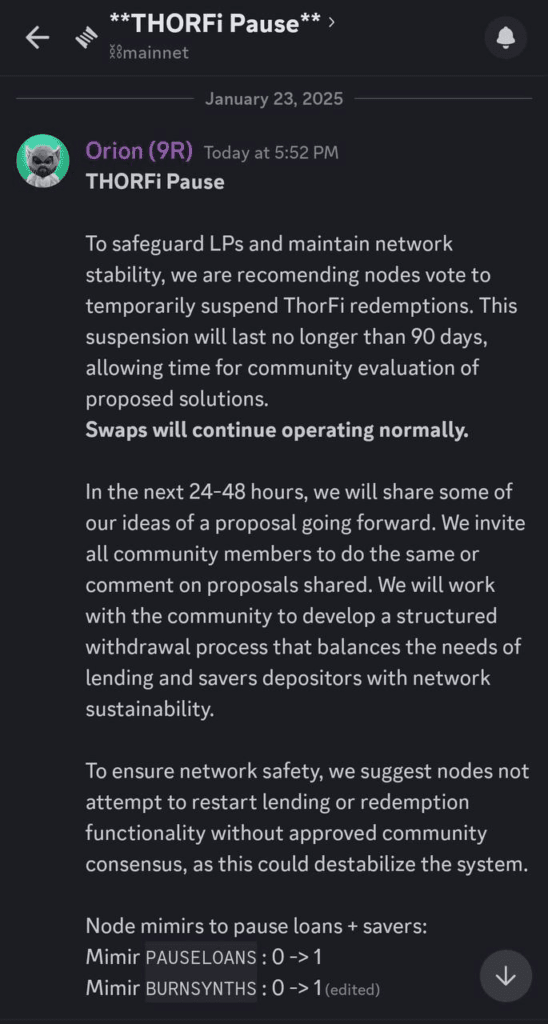

On Jan. 23, after intense discussions, node operators voted to pause redemptions for Lending and Savers. THORChain had accumulated roughly $200 million in liabilities. The response was swift. In the following days, 31 validators exited. Liquidity shrank by $100 million. The price of RUNE plummeted.

THORChain: A game-changer in cross-chain liquidity

Despite the turbulence, THORChain continued to operate. Cross-chain swaps are processed as usual. Vaults and validators churned. Blocks were produced. Revenue flowed. The network’s resilience was on full display. It adjusted to market conditions without faltering

The pause on Jan. 23 paved the way for restructuring. The community mobilized. Eight independent plans emerged. Node operators reviewed and voted on them. On Feb. 2, they selected Proposal 6. AaluxxMyth of Maya Protocol submitted the winning plan.

Developers across platforms pledged to collaborate immediately. Implementation specifics began sharpening with working groups at Maya Protocol, Nine Realms Capital, Rujira Network, and Strangelove Labs. Next comes execution. Having a concrete rollout schedule is key.

The plan turns $200 million in debt into equity. A new token will be added to lock in 10% of THORChain’s earnings in perpetuity. The desire for long-term sustainability is present. By aligning incentives, the protocol strengthens its financial pillar.

The decision validates THORChain’s malleability. Instead of shrinking under tension, it grew. Contraction under marketplace whims did not break the system. It simply reorganized it. With a new format in place, Thornchain moved forward.

THORChain: Undergoing transformations for a stronger DeFi future

The community’s capacity for survival through crises is a key to its long-term survival. What happens in the future is uncertain, but the network’s durability cannot be questioned. Instead of collapsing under strain, it has developed, showcasing its capacity for development and expansion.

Currently, THORChain is in a critical restructuring after a $200-million debt crisis amid a long-standing financial challenge. In an attempt to tackle the financial challenge, the decentralized liquidity protocol has mooted a new token, namely, TCY (Thorchain Yield), in a 90-day restructure scheme.