The World Economic Forum (WEF) encourages policymakers and regulators worldwide to test and develop DeFi innovations in controlled environments, known as regulatory sandboxes. These sandboxes allow for safe experimentation while focusing on managing risks and transparency.

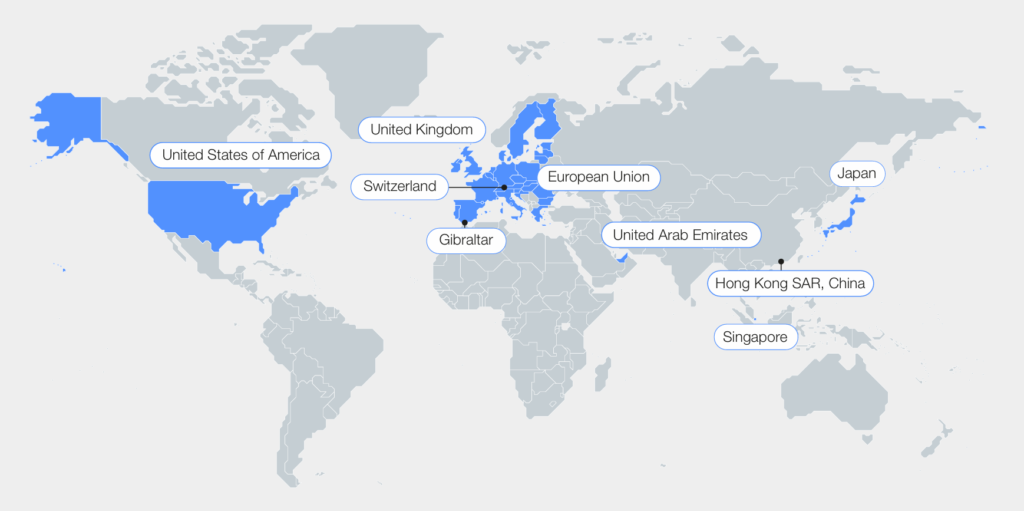

In a recent review of nine major economies, including the U.S., U.K., Japan, and the UAE, the World Economic Forum highlighted the importance of creating customized regulations for the DeFi space. This approach allows for testing new ideas in a controlled environment, helping to manage risks and maintain transparency while staying within legal boundaries.

The World Economic Forum (WEF) has noted that countries embracing a flexible, sandbox-first strategy to tackle the DeFi risks. Moreover, they advocate for creating a controlled environment where digital assets and decentralized protocols can be tested safely:

The success of regulatory sandboxes highlights the potential for collaborative innovation in DeFi.

Bridging DeFi and traditional finance

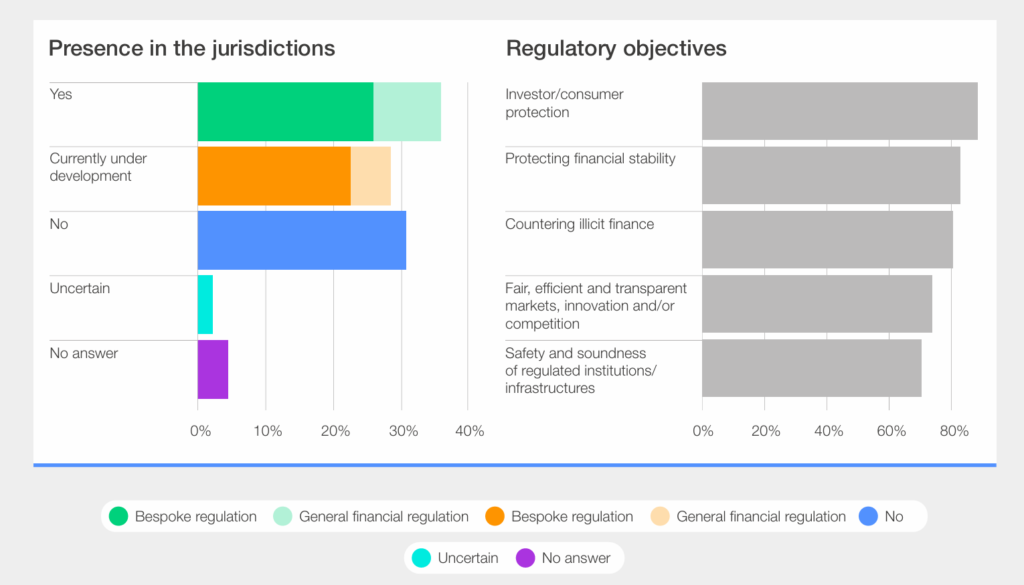

The World Economic Forum pointed out that just 9% of the places they studied have adapted current financial regulations to cover digital assets. Only the UK, Hong Kong, and Singapore have created or are working on specific regulatory frameworks for these assets.

The report also mentioned that licensing models considering the decentralized nature of DeFi have been beneficial in driving progress. Specifically, the World Economic Forum report suggests that policymakers and regulators should look into ways to balance protecting consumers, ensuring market integrity, and encouraging innovation by adjusting the rules and definitions for decentralized networks.

The European Blockchain Sandbox Initiative (EBSI) has recently brought together 41 authorities and regulators from 22 countries to join the second group of its blockchain sandbox program.