The XRP Ledger is transforming institutional DeFi with new features like tokenized real-world assets (RWAs), automated market makers (AMMs), and price oracles. These upgrades position XRPL as a top choice for financial institutions looking to adopt blockchain technology.

According to the blog post, XRPL’s native DEX has been a core feature for over a decade, ensuring deep liquidity and efficient price discovery. The recent addition of AMM through the XLS-30 standard enhances this further.

Unlike traditional AMMs, XRP Ledger’s version integrates with the order book, optimizing swaps and reducing impermanent loss. This makes it attractive for institutions providing liquidity.

Tokenized RWAs are another major development. Assets like treasuries and real estate can now be traded more efficiently. XRPL’s compliance-friendly architecture supports secure trading while meeting regulatory requirements. Institutional players can now deploy capital in AMM pools to generate yield and engage in arbitrage across DeFi ecosystems.

Decentralized Identity (DID) on XRPL for compliance

Decentralized identity (DID) on XRP Ledger adds another layer of security. With XLS-40 live, institutions can manage self-sovereign identities directly on the ledger. This enhances KYC and AML compliance while preserving privacy. It also enables permissioned access to regulated trading venues and lending platforms.

XRPL’s integration of price oracles ensures accurate market data for tokenized assets and cross-chain transactions. Providers like Band Protocol and DIA deliver real-time price feeds, improving risk management for institutional DeFi. Reliable data is essential for maintaining asset valuations and supporting on-chain lending.

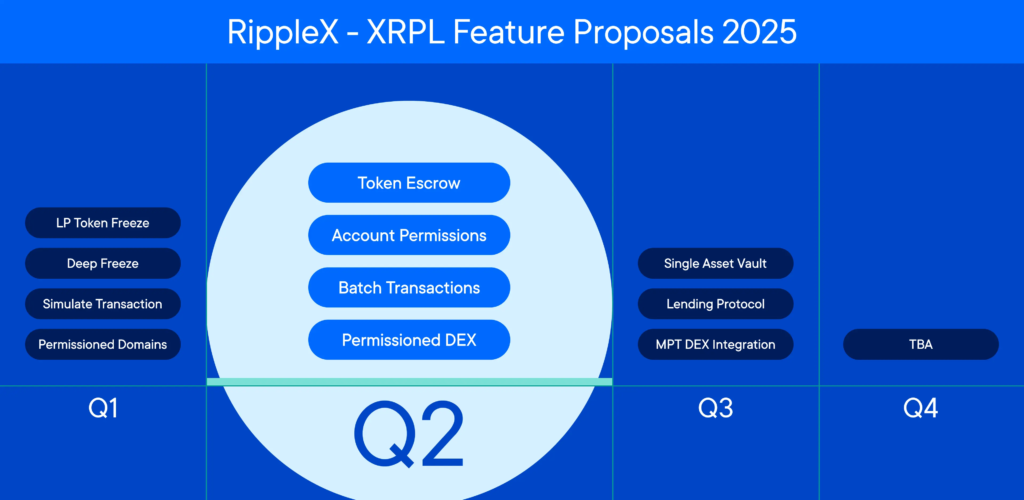

Looking ahead, XRP Ledger is preparing for even greater adoption with new compliance tools, institutional lending solutions, and programmability enhancements.

The upcoming permissioned DEX will allow institutions to trade within regulated environments while maintaining decentralization. Multi-purpose tokens (MPTs) are also in development, allowing for the tokenization of complex financial instruments like bonds.

The XRPL EVM sidechain, set to launch in 2025, will further expand programmability by allowing developers to build with Solidity and connect with existing Ethereum-based applications. This integration will attract more projects to the XRP Ledger ecosystem.