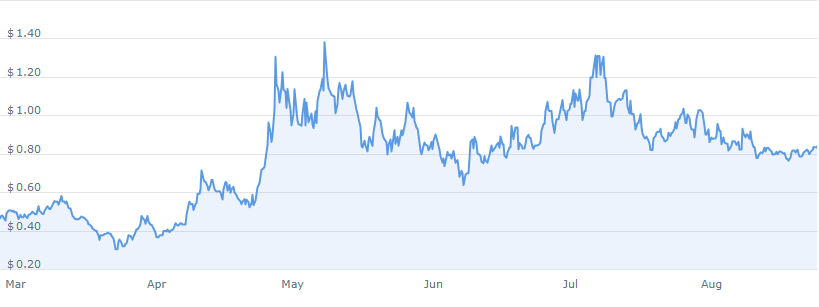

Dogwifhat has attracted interest as its price is consolidating within a narrow band, signaling resilience after recent declines. The token has managed to stabilize near $0.80–$0.83, where both purchase and selling sides are active, keeping the liquidity intact and highlighting the token’s near-term period of criticality.

Currently, Dogwifhat is trading at $0.841763, up 1.30% in the last 24 hours. The 24-hour trade volume is $391.44 million, and its market value stands at $840.79 million. The market share of WIF is 0.02%, a testament to consistent investor demand amidst overall market turbulence.

Open Interest data shows strong support around $0.81, yet the token cannot breach the resistance at $0.83. Consistent retests of the said level underline continuous selling pressure. Nevertheless, purchasers persistently defend descents towards $0.80, creating a credible floor that continues to stabilize market sentiment amidst volatile conditions.

Dogwifhat consolidation and liquidity build-up

Another key observation is tightening intraday ranges, as daily swings have narrowed across recent sessions. This contraction signals reduced volatility, a hallmark of consolidation phases. Conventionally, such movements accumulate liquidity in significant price regions before breakout moves, themselves springboards to healthy directional momentum once breakout dynamics accumulate.

Predictions are that WIF can remain swinging within its current range before bigger drivers kick in. If the $0.80 support remains intact, it could act as a launchpad for recovery. However, any failure to maintain this base risks sharper pullbacks, exposing deeper levels where further downside may materialize.

Technical signals hint at bullish possibility

Momentum indicators reveal more information, and the MACD histogram shows a positive 0.005. The MACD and Signal lines are still close to zero, and there is a possible MACD crossover. This type of development would be characteristic of the first days of a bullish reversal if the build-up in momentum persists.

Another positive factor in the crypto market is whale accumulation, as bigger holders gradually increase their positions in support areas. This signal for a long upward trend, particularly if a positive sentiment is confirmed. The WIF could be hitting the levels of the first resistance zone or even higher if the accumulation continues, which means that the targets can fall within a range from 0.90 to 1.00 dollars.