Ethereum’s future looks bright as its issuance heads downward. The Ethereum Foundation researcher Justin Drake believes that Ether will soon become “ultrasound” money. He sees Bitcoin struggling as it nears its 21 million cap. The debate between the two communities has intensified.

Currently, Ethereum has a 0.5% yearly supply growth. Issuance stands at 1% per year, while burning removes 0.5%. To achieve “ultrasound” status, issuance must shrink, or burns must increase. Drake expects both to happen.

Security concerns: Bitcoin vs. Ethereum

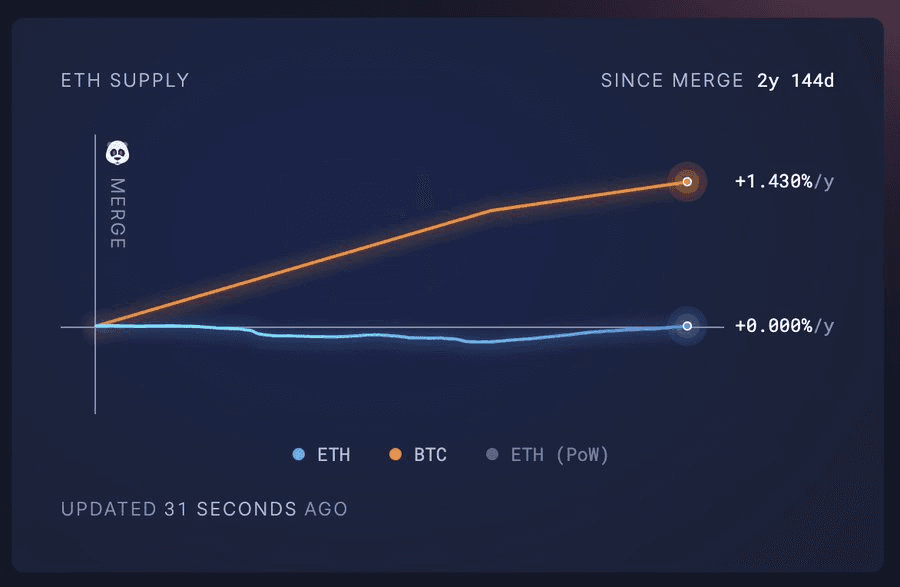

The battle for internet-native money comes down to Bitcoin and Ethereum. Gold is losing relevance in the digital age. For any asset to win, it must be neutral, secure, and scarce. Ethereum’s scarcity now outpaces Bitcoin’s. Since the Merge, Bitcoin’s supply grew by 666,000 BTC, worth $66 billion. Ethereum’s supply, meanwhile, remained steady. Bitcoin expands at 0.83% per year, 66% faster than Ethereum.

Scarcity matters, but security will decide the future. Bitcoin’s 21 million cap is its greatest strength and weakness. Its issuance is heading to zero, reducing incentives for miners. This threatens network security. In the last week, 99% of Bitcoin miner revenue came from issuance, not fees. Four halvings have cut issuance by 16 times, yet fees remain negligible. Without strong transaction fees, Bitcoin’s security crumbles.

A 51% attack on Bitcoin would cost around $10 billion. A single US state, Texas, produces eight times the energy needed. Bitcoin’s security ratio stands at 200-to-1. For a $2 trillion asset, that’s weak protection. The presence of mining stocks and derivatives further increases attack incentives. $20 billion in mining stocks and $40 billion in perpetual futures create opportunities for shorting. If Bitcoin is compromised, these instruments would collapse instantly.

Bitcoin’s hope lies in higher fees or protocol changes. BitVM, a new scaling proposal, could increase fees. But it also introduces new vulnerabilities. Attackers could censor fraud proofs and drain bridges. A move to Proof of Stake or a new Proof of Work algorithm is unlikely. Bitcoin’s rigid design resists change.

Taxation and sales pressure on staking rewards

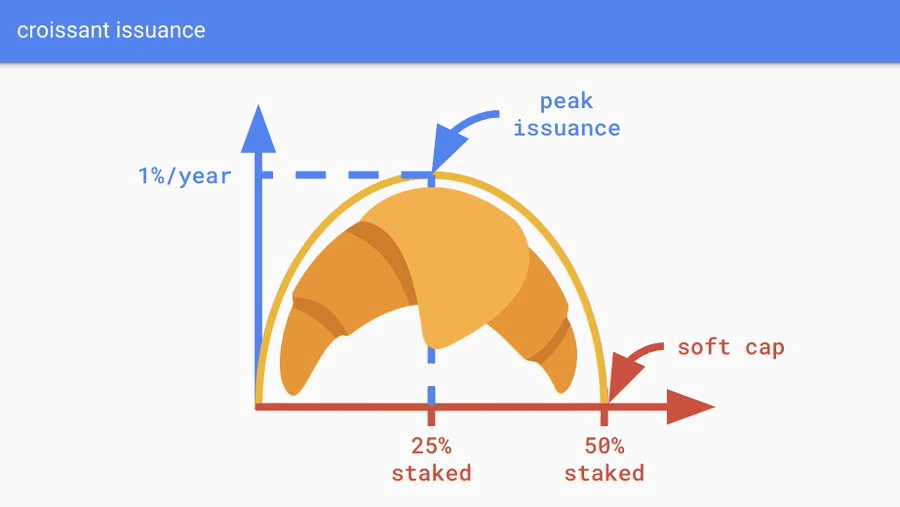

Meanwhile, Ethereum faces its own challenges. The current issuance model is flawed, guaranteeing 2% tail rewards even with full staking. If all ETH gets staked, dilution becomes a problem. Liquid staking derivatives like stETH introduce additional risks. Additionally, taxes on staking rewards create sales pressure. Drake proposes “croissant issuance,” a flexible model that adjusts based on staked ETH levels. A 50% staking cap would balance security and inflation.

Furthermore, burning ETH through data availability is key. Scaling with EIP-4844 temporarily reduced burns. But as demand rises, burns will return. Future upgrades, like the Pectra hard fork, will increase data capacity. This ensures long-term sustainability.

Ultimately, the next decade will determine the winner of digital money. Bitcoin’s security model is crumbling. Ethereum, through issuance and burn adjustments, is positioning itself as the dominant force. The market will decide, but Ethereum appears to have the edge.