Ethereum co-founder Vitalik Buterin has just released a blog entry discussing the long-term worth of scaling Layer-1 (L1) by 10x, irrespective of the prevalence of Layer-2 (L2) solutions in the environment.

Buterin makes the case that near-term L1 scaling, over the next two years, has essential implications for the functionality, security, and cost-effectiveness of Ethereum.

Vitalik highlights several use cases where an enhanced L1 is crucial. For instance, censorship resistance on L2s depends on an accessible and scalable L1. L2 mass exits, cross-L2 transfers, and issuing ERC-20 tokens on L1 also require higher L1 capacity. Without such improvements, high gas fees could hinder Ethereum’s usability.

The blog discusses the ongoing debate over increasing Ethereum’s L1 gas limit. Recently, the limit rose from 30 million to 36 million, boosting capacity by 20%. While some support further hikes, concerns about centralization risks remain.

Vitalik cautions against rushing decisions. While increasing gas limits is easy, reversing them is challenging. Centralization risks from heavy L1 usage could have lasting consequences.

Scaling L1 gas would reduce transaction costs and enable smoother application operations. For example, bypassing L2 censorship currently costs $4.50 but could drop to under $1 with a 4.5x L1 scaling.

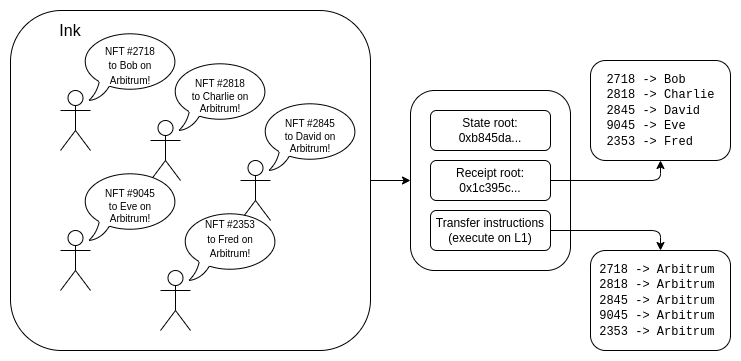

Ethereum and cross-L2 asset transfers

Similarly, cross-L2 NFT transfers, now costing around $13.87, could become as low as $0.28 with optimized designs and scaling improvements. Vitalik also underscores the importance of supporting mass exits from L2s during potential failures.

Current gas limits allow millions of users to exit within a week, but a higher capacity is needed to handle events like hostile governance upgrades or systemic breakdowns. Scaling by up to 9x could mitigate these risks and significantly reduce exit costs.

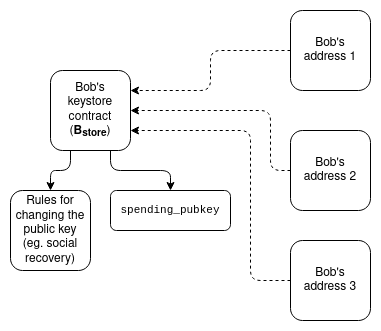

The blog also touches on other use cases, such as launching ERC-20 tokens on L1, which offers security benefits against governance risks on L2s. Moreover, keystore wallet operations, essential for user security and flexibility, would benefit from a scalable L1, reducing gas costs and improving efficiency.