U.S. regulators have paused a key decision on Ethereum ETF options. The Securities and Exchange Commission (SEC) says it needs more time to decide whether to allow trading of options tied to Ether exchange-traded funds (ETFs).

A filing on Feb. 7 confirmed the delay. The SEC cited the need for further review. The proposal, first submitted by Nasdaq ISE, aims to list and trade options on the iShares Ethereum Trust. Nasdaq ISE filed its request on July 22, 2024. The SEC opened the plan for public comments in August. Feedback followed. Some supported the move, while others raised concerns.

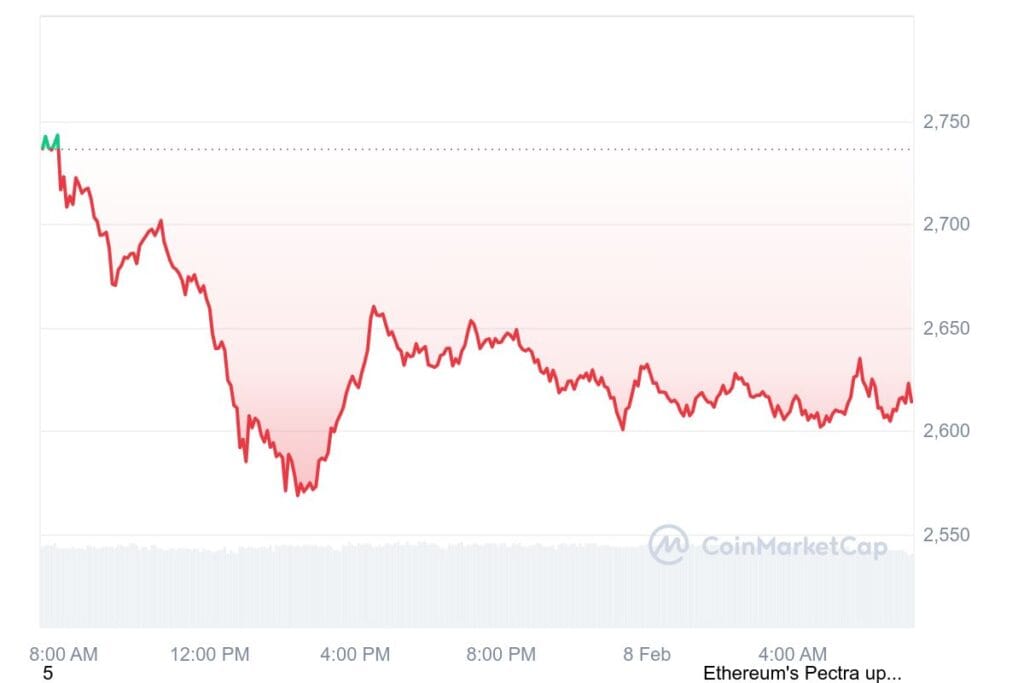

Ethereum market reacts to SEC Delay with a price decrease

In September, the review period for the SEC was extended. The agency desired additional time to deliberate its options. In November, it initiated a deeper review. That move indicated uncertainty. The SEC must make certain that the proposal is in compliance with current legislation.

Under current laws, the SEC must approve or deny proposals within 180 days of publication. That date fell on Feb. 8, 2025. Regulators, nevertheless, have a 60-day option to extend that timeline in times of necessity. That option has been utilized by the SEC. That new date is April 9, 2025.

Investors are closely tracking. Clearing could open new doors for speculators. Options allow investors to bet, manage risks, and speculate on price variation. Ethereum’s presence in traditional finance will go even deeper. Caution at a regulatory level prevails. The SEC closely examined crypto offerings in general. Bitcoin ETFs saw years of ping-pong, and such scrutiny faces ether-related offerings.

April’s verdict could shape Ether’s role in traditional finance

The market reacted with a muted response. Following the report, Ethereum’s price ranged at approximately $2,620. There have been investors who predicted a delay, but a quick approval was hoped for by others. The April deadline is in consideration. An approval could push Ethereum deeper into mainstream finance, and a rejection could mean continued regulatory hurdles. Regardless, investors will monitor its every move.