Analysts are eying a potential Ethereum surge past $3,200, fueled by a growing appetite for risk following Donald Trump’s win in the U.S. presidential election. On Nov. 6, Trump was announced as the winner, securing a second term as President of the United States.

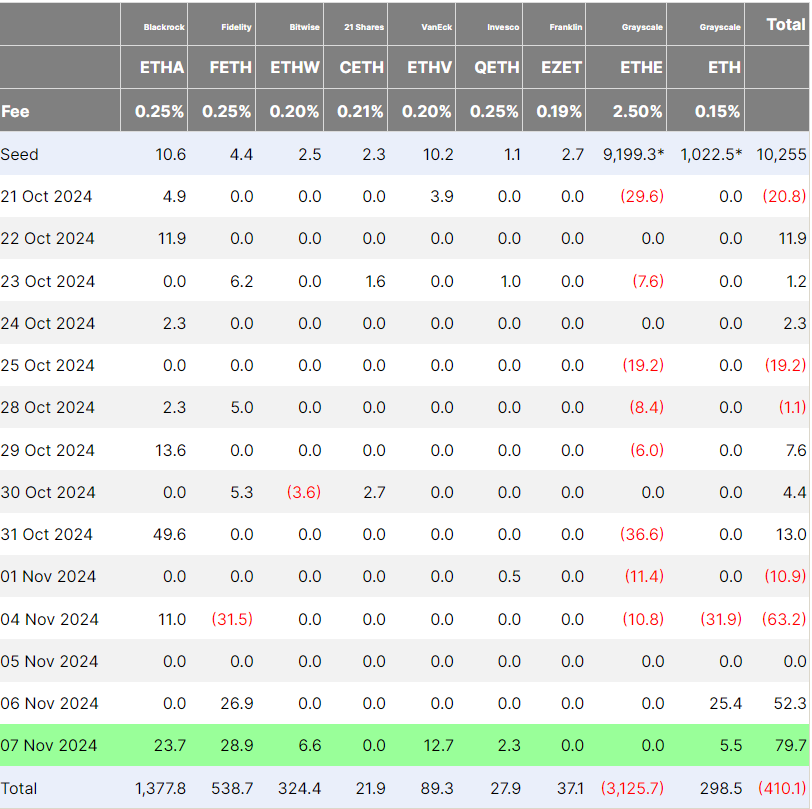

Following the U.S. election results, spot Ether ETFs saw a shift to positive inflows, with investors adding $52.3 million on Nov. 6 and $79.7 million on Nov. 7, according to data from Farside Investors.

Analysts at Bitfinex suggest this uptick in ETF inflows, combined with rising investor interest fueled by the Republican win, could drive Ethereum price up to $3,200 soon. As of Nov. 8, Bitcoin’s dominance in the crypto market hit 60.4%, hinting that Ethereum might prepare for a breakout soon.

Crypto market poised for breakouts after election

Analysts are growing more optimistic about the crypto market’s direction post-election, especially with Trump expected to serve another presidential term. Bitget Research’s chief analyst, Ryan Lee, is among those who believe Bitcoin could hit the $100,000 mark before 2024 wraps up. Ethereum price is already becoming more volatile as spot market buying picks up after the elections.

With open interest on the rise, this momentum could set for a short-term breakout. Reflecting strong investor confidence, Bitcoin hit a new record high, climbing above $76,400 on Nov. 6. Analyst Edward Wilson from Nansen predicts that a Trump administration may push for more innovation in the crypto sector, including launching the first staked Ether ETF.

More Ether-based ETFs could potentially boost Ether’s price beyond its previous all-time high of $4,800, set back on Nov. 16, 2021, nearly three years ago. For Bitcoin, about 75% of new investments poured into ETFs when its price climbed past $50,000 in February, just a month after spot BTC ETFs launched for trading in the U.S.

Related | Robinhood CLO Dan Gallagher touted for SEC leadership