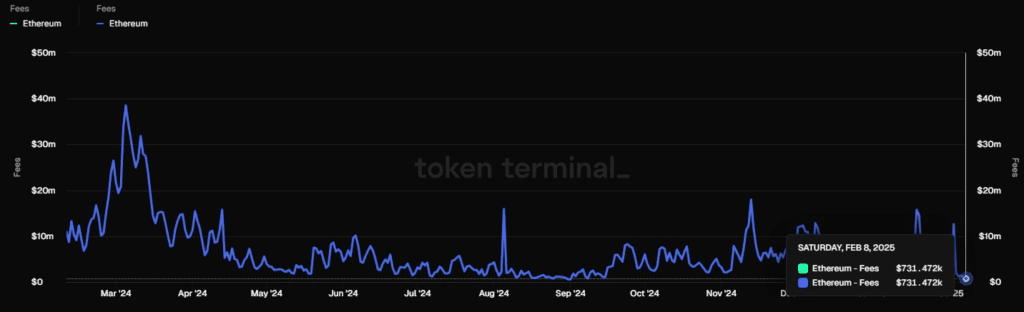

Ethereum’s daily transaction fees have hit a five-month low. Data from Token Terminal reported that on Feb. 8, Ethereum fees dropped to $731,472.

This marks the first time since Sept. 2024 that daily revenue dipped below $1 million. There was a comparable drop from Aug. 17 to Sept. 8, 2024. Ethereum last observed this pattern in Nov, 2020. Investors now face a tough reality. ETH has failed to rally, even as Bitcoin surged following spot ETF approvals in the US and Hong Kong.

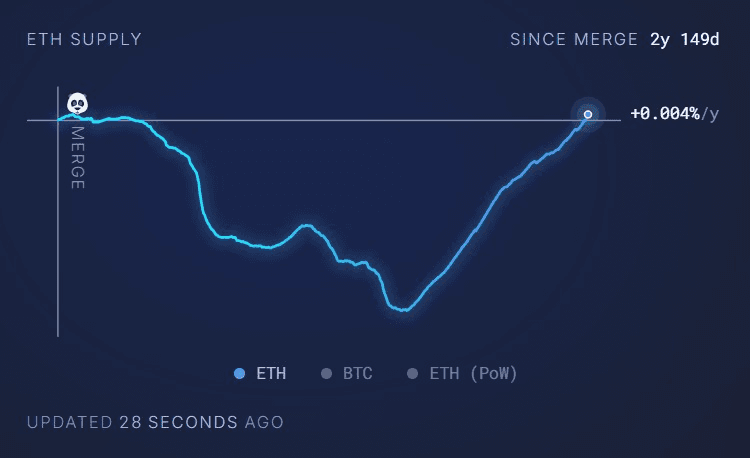

The broader crypto market remains sluggish. Trade tensions and economic uncertainty have weighed on digital assets. But Ethereum’s struggles go beyond macro trends. Since April 2024, its total supply has been rising, undoing the deflationary effects of the merger from Sept. 2022. Supply has now surpassed pre-merge levels.

Layer-2 scaling solutions have helped ease congestion. Fees have become more predictable. But there’s a trade-off. Transactions have shifted away from Ethereum’s main network, reducing fee revenue. Fragmentation remains a concern as interoperability challenges persist across these scaling solutions.

Competing blockchains are catching up in the meantime. Tron has grown to be a significant player in stablecoin transactions. In the field of decentralized finance (DeFi), particularly memecoins, Solana is still expanding. Both networks have produced higher transaction fees than Ether in the last three months.

Ethereum faces governance and leadership uncertainty

Ethereum also faces internal struggles. Leadership tensions surfaced in January when Vitalik Buterin took full control of the Ethereum Foundation. Executive director Aya Miyaguchi faced scrutiny over alleged conflicts of interest linked to researchers at EigenLayer. Uncertainty over governance has added to investor concerns.

Despite these headwinds, Ethereum still commands strong support. On Feb. 7, accumulation addresses acquired 330,705 ETH, worth $833 million. CryptoQuant reports this as the largest single-day ETH inflow ever recorded.

Ethereum’s future remains uncertain. The adoption of layer-2 networks has lowered fees but also raised questions about decentralization. Competitors continue to challenge its dominance. Internal governance struggles add further complexity. However, strong accumulation signals that some investors remain confident. For now, Ethereum’s next move is anyone’s guess.