Ethereum profitability has plummeted, falling to its lowest point in four months. The cryptocurrency’s market capitalization has dropped 36% from its local top during the last seven weeks, resulting in a notable decline in the quantity of profitable ETH tokens.

Ethereum currently has the lowest percentage of profitable coins on a daily close basis in more than three months. Many traders have sold off their holdings due to this downturn, which has increased their fear, uncertainty, and doubt (FUD).

Ethereum is performing lower than other major assets, even though it is the second-largest cryptocurrency. Retail investors’ withdrawal of their stakes has increased selling pressure. Analysts predict that Ethereum may see an unexpected recovery if the market mood stabilizes. The current state of the market is critical for ETH traders, though, since persistently negative momentum may portend a protracted collapse.

Ethereum drops 5.37% as the MVRV oscillator signals a reversal

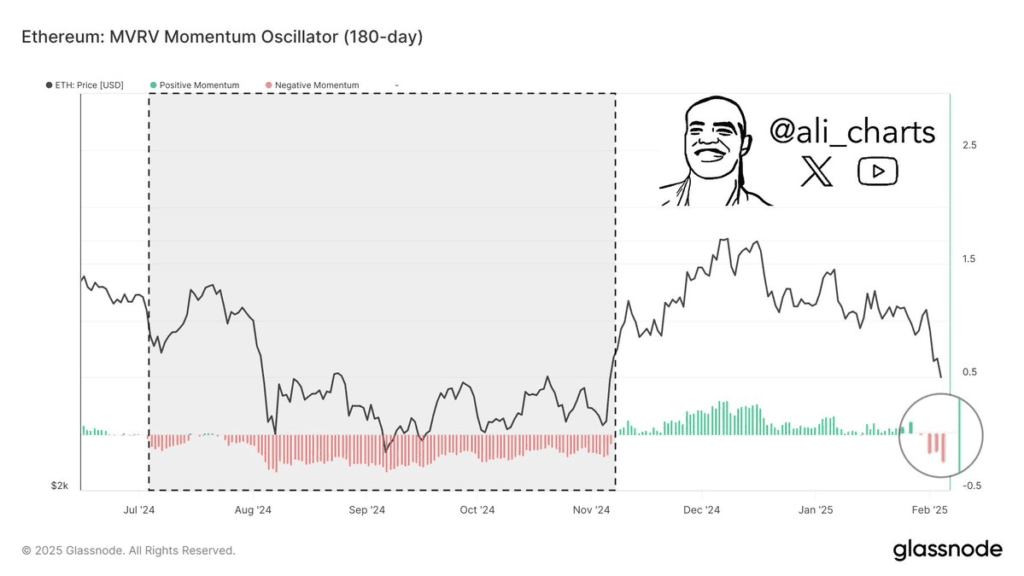

Analyst Ali has pointed out a key movement in Ethereum’s MVRV Momentum Oscillator (180-day), a metric that historically signals price reversals. This indicator compares Ethereum’s market value to its realized value. Green bars suggest a strong market sentiment, while red bars indicate increased selling pressure.

Ethereum’s price has dropped significantly since its early Jan. 2025 peak, with the MVRV momentum slipping into negative territory. This implies that short-term traders are currently holding losses. If selling pressure subsides, a trend reversal has historically been preceded by a change into negative momentum.

Ethereum might be close to its lowest point, indicating a potential recovery. If past trends repeat, Ethereum could bounce back. But if negativity continues, it may drop further. A shift to positive momentum is needed for recovery

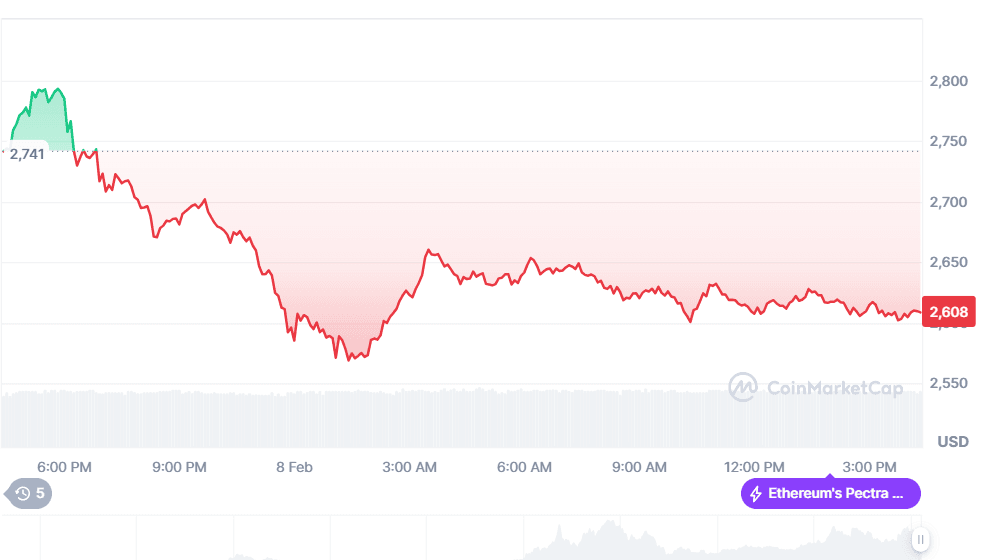

Over the past 24 hours, Ethereum has dropped 5.37%, with its price sliding from $2,757 to $2,609. The market cap declined to $314.55 billion, while trading volume rose 1.33% to $29.37 billion. Despite minor stabilization attempts, ETH remains in a downtrend, trading between $2,550 and $2,750 without clear signs of a reversal.

Furthermore, Ethereum is still struggling against Bitcoin. The ETH/BTC pair is still below 0.034, a crucial level that analysts think needs to be broken for a more extensive altcoin season.

At the moment, ETH is within a major support zone of 0.027–0.029, with resistance at 0.034 and 0.0399. Ethereum could push towards 0.04 and beyond if it regains 0.034, but if it doesn’t, it might test 0.027 again, prolonging its bearish trend.