Ethereum has been facing grave difficulties, and its reputation in the crypto ecosystem has been declining. It was once a giant in on-chain trading and revenue generation, but it has now seen a steep decline in terms of adoption and value.

According to the report from VanEck, the use and adoption of Layer 2 (L2) scaling solutions and heightened competition from more efficient blockchains have been the principal reasons behind it. Ethereum’s strategy to incentivize users to move to L2s has made transaction fees cheaper but has also lowered demand for blockspace.

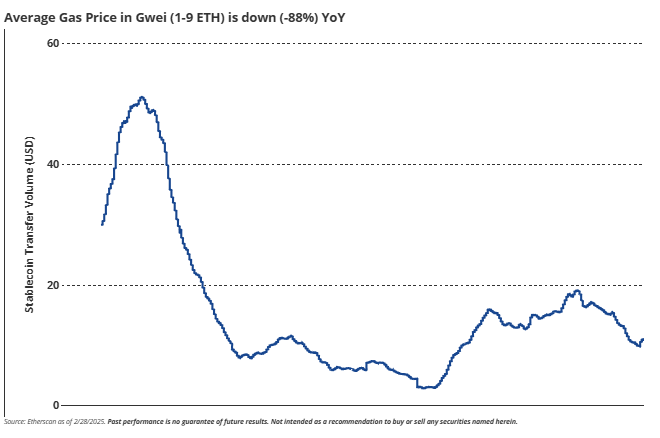

With fewer Mainnet transactions, gas prices have fallen by 88% in the past year. This has had a drastic impact on Ethereum’s revenue, which has fallen by 93%. The value of Ethereum blockspace has been at its lowest level since mid-2024 in both ETH and USD terms.

Another consequence of this reduced activity is Ethereum’s shift away from being deflationary. The EIP-1559 mechanism burns ETH as part of transaction fees, but with fewer transactions, less ETH is being burned. This has weakened ETH’s economic model, further impacting investor confidence. Ethereum’s share of total blockchain revenue has plummeted from 55% in Feb. 2024 to just 24% in Feb. 2025.

Ethereum loses key projects to competitors

Major projects are now leaving Ethereum in search of better efficiency. Uniswap, which contributed 11% of Ethereum’s revenue, is expanding beyond Ether. Ondo, an RWA platform managing around $1 billion in assets, has also moved to other networks.

Even Ether Name Service is looking at alternative blockchain solutions. These shifts highlight Ethereum’s struggle to compete with newer, more powerful networks. Ethereum’s very fundamental mission is also divided. It wishes to be a decentralized platform, a financial infrastructure, and a store of value.

However, these goals conflict with each other. Competitors like Solana and Bitcoin have focused on a single goal—Solana focuses on fast transactions, and Bitcoin focuses on being a store of value. Having a single aim has led them to outperform Ethereum in recent months.

Despite these challenges, the network is changing. The upcoming Pectra upgrade will increase the gas limit and reduce validators. Though these measures will improve efficiency, they have raised concerns about Ethereum compromising decentralization.

The network maintains a central position in the crypto ecosystem, but it can no longer do so for granted. Unless it acts to contain mounting competition and inefficiency, valuation and market share can continue to be eroded.