Ethereum has maintained resilience despite the wider bearish tone across the crypto market. Over the past day, the asset has remained almost stable, trading around $4,280.56 at the time of writing.

This comes even though its value dropped 7.6% over the past week, reflecting broader market turbulence. Ethereum’s 24-hour trading volume currently stands at $35.66 billion, down by 22.5%, while its market capitalization rests at $516.68 billion.

The price movement indicates consolidation, with Ethereum’s current position suggesting that buyers are waiting for a stronger signal before committing further capital. While short-term activity appears muted, the long-term technical outlook signals a potential upside move. Market participants are closely watching the evolving chart structure for confirmation of this trend.

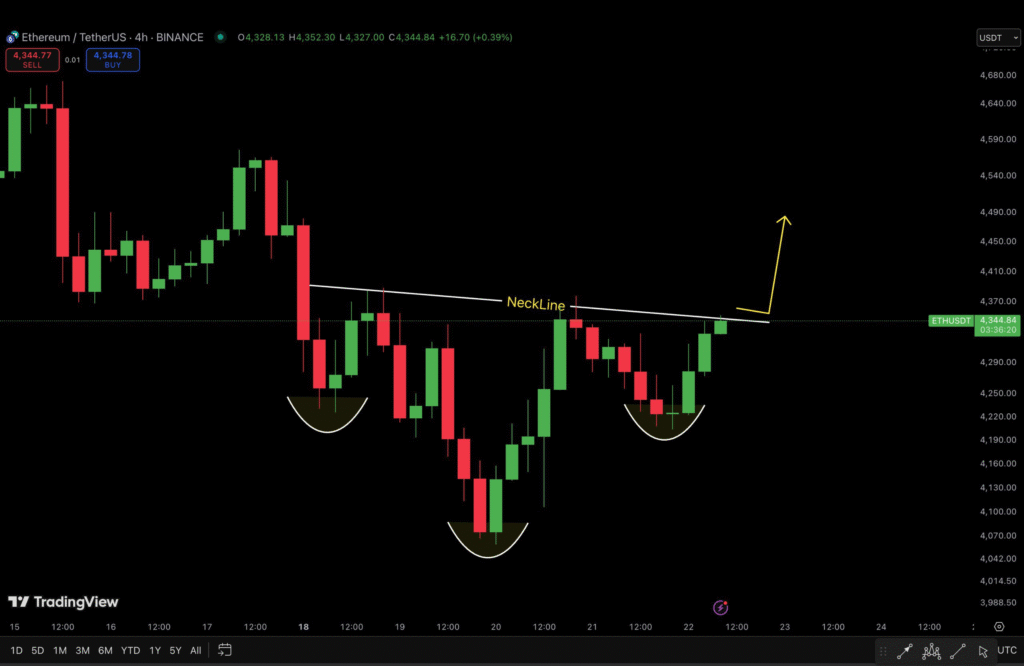

Ethereum bullish reversal pattern in formation

The chart presents an inverse head and shoulders formation developing on the four-hour chart of Ethereum. The classical reversal shape consists of three independent troughs, and the second drop (the head) lower than the former and the last shoulders.

A neckline lies in the $4,340–$4,360 area, forming an essential level from which Ethereum needs to break to validate bullish continuation. At the spot price of $4,280.12, Ethereum lies just below this neckline. For confirmation, a breakout above this area of resistance in convincing momentum is required.

A successful retest of the neckline as support will add even more credibility to the bullish thesis. From the measured move of this chart formation, Ethereum can rise to $4,610. But the traders are also eyeing a bigger target of $4,900.12 if momentum establishes beyond the near-term expectation.

The risk management continues to be significant, with the stop-loss levels recommended around $4,150–$4,200 to protect against a false breakout. Until the decisive move, the Ethereum is poised at the critical point whose direction the next trend will decide.

Market Pprticipation signals caution

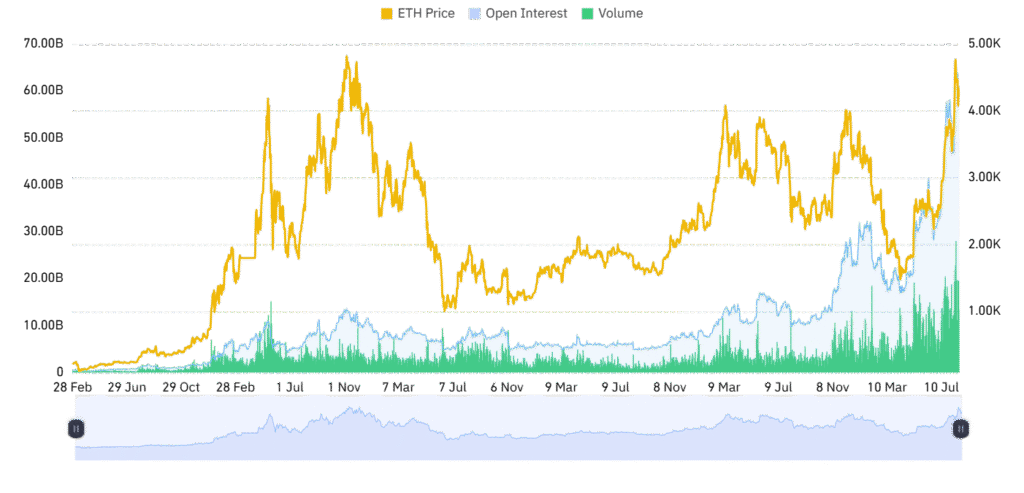

Even though the chart of Ethereum suggests a possible breakout, market involvement presents a less enthusiastic picture. Volume has eased, dropping -21.85% to $115.47 billion and the open interest falling -0.38% to $60.77 billion. The fall indicates certain traders are waiting until confirmation materializes before committing.

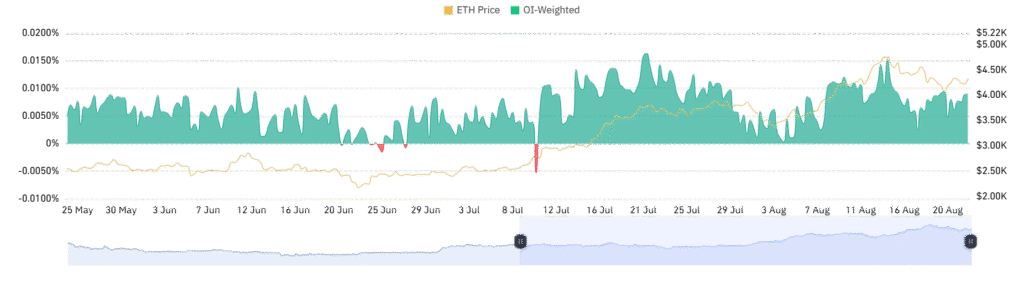

The OI-weighted sentiment, however, reads 0.0143%, which indicates a slightly positive and even sentiment. Absence of aggressive leverage supports healthier conditions and narrows risks of sudden reversals. However, if the volume and the open interest begin rising together through a breakout above the neckline, this will support confidence in the next phase of the rally of Ethereum.

For the time being, the coin continues to be set up for possible upside. The technicals are positive, but validation through market action will decide if momentum propels the asset into the $4,610–$4,900 area.