Ethereum network’s roadmap sparks intense debate. The DeFi Report’s founder, Michael Nadeau, dives deep into its economic impact. Each change ripples through developers, users, validators, service providers, and investors.

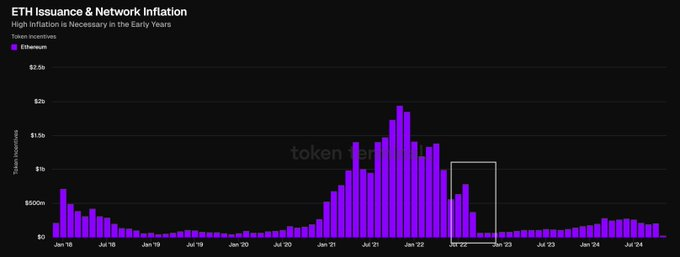

According to his analysis, since its introduction in Aug. 2021, EIP-1559 has literally burned ETH worth $12.4 billion. It has brought a new trend in supply and demand, along with the token’s rising value. This major turn came when Ethereum was Switched to Proof of Stake in Sep. 2022. As a result, annual ETH issuance was cut down by 88% overnight.

Validators saw some great changes: Compensation now involves user tips and minimal new issuance, reduced from 13.5k ETH per day to 1.7k. Energy overhead drops 99.9%: Validators earn based on their ETH staked pro-rata to the total amount staked.

Ethereum Shapella upgrade and validator growth

The implementation of Shapella’s staking withdrawal upgrade in April 2023 resulted in the boosting of the validator numbers by 58% over a half-year period. Meanwhile, the recurring yield reductions, aside from them being the root cause of token holders’ demise, also significantly influenced demand. The increased validator count heightened the security of the network. Lido Finance recorded large surpluses.

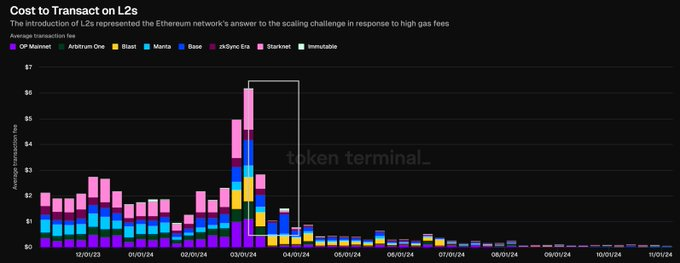

The EIP-4844 implementation of the “Blobs” in March 2023 is where fees of L2 transfers are reduced by a huge chunk, thereby becoming the development for the whole system. Users experienced a large drop in fees. On the other hand, the L1 validators have seen a decrease in the rewards because the reduction of L2 charges reduced L1’s share of earnings.

While L2 sequencers experienced fee drops, however with higher transaction volumes, stakers also witnessed fewer ETH burns by token holders, which has affected the staking rewards of these holders. The margins of L2s have surged to 99% amidst a developing ecosystem that’s encouraging developers to explore new use cases.

Ethereum’s design is working, with 90% of all transactions today running on L2. However, the more crucial point remains where the value accrues. The market still prices L1 at a valuation of 13 times the top L2s combined. Whether this will changeor not-is something only the future will show.

Related | Bitcoin ETFs face consecutive outflows as election unfolds